Letter from the Chief

Executive Officer

to the Ordinary General Shareholders Meeting of Megacable Holdings S.A.B. de C. V.

We have become a benchmark for companies in our sector as a result of our strengths.

Esteemed Shareholders and Members of the Board of Directors:

The end of 2016 and the beginning of 2017 were challenging times for the Company, as a result of economic instability in the country, including a rise in inflation stemming from increased energy prices, and other operational factors, such as changes to programming and the negative effects of the analog shut down; however, our strength and experience have enabled us to turn these challenges into opportunities for growth through a more efficient commercial strategy, which has led to successful results.

We have become a benchmark for companies in our sector as a result of our strengths: a highly innovative spirit, cutting- edge technology, rational and effective investments, careful cost control, outstanding service, our capacity for growth, and the leadership we have shown over time.

Another Year of Exponential Growth.

One of our major achievements in the mass market was the 12% increase in RGU’s (Revenue Generating Units) compared to 2016, reaching 7,131,854.

We also achieved an 8% increase in RGU’s per unique subscriber, reaching 2.09, which means that our packaging strategy has been a success, allowing us to increase our presence in the households we serve offering a wider range of services.

Job creation has also been a significant indicator as the number of employees has increased in line with the Company’s growth, although this has occurred at a slightly lower rate as a result of increased productivity. Today, we have better trained and better paid employees.

We have rolled out an improved sales strategy with new products, ensuring an increase in the number of subscribers, mainly in the cable segment, where, after a complicated first quarter, we successfully closed 2017 with a 2% increase in a year-on-year comparison. In terms of Internet subscribers, we grew by 18%, while the Telephony segment increased by 25%. Our Corporate segment continued growly quickly thanks the expansion of our operations.

We know that good results are, to a large extent, the result of the highly committed and trained team we have, which is why we have implemented strategies to improve working conditions and drive employee development.

Monitoring our strategy, making the right decisions at the right time, and driving integration between the Company’s areas have allowed us to improve the indicators for the first quarter of the year and achieve the goals we set for ourselves in 2017.

The experience of the Board of Directors and the leadership of our management team have allowed us to keep Megacable on the right path, helping it become the best telecommunications company in Mexico.

It is with great pleasure that we present the results achieved in 2017:

Video

To the end of 2017, we had a total of 3,040,278 subscribers, a 2% increase compared to 2016. Revenue for this business unit dropped by 5% as a result of a lower number of average subscribers per year. It is important to highlight the recovery made in this segment, with the subscriber base growing by 5% over the past 9 months, after the downward trend seen in Q1 2017, stemming from the analog shut down and changes to programming.

Negotiations with content providers have been fundamental and continue to produce positive results, considerably reducing costs and driving profitability.

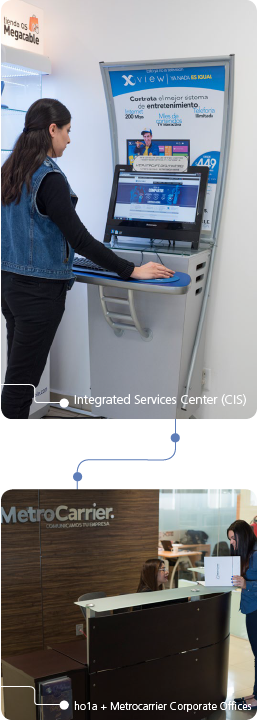

Our star product, Xview, has been widely accepted by subscribers, given that it represents a new way of watching the TV, offering interactive channels on TV screens or mobile devices via a user-friendly and intuitive platform.

This product also offers subscribers the opportunity to watch programs, series, sports and news shows that are aired live or over the past 48 hours. This platform includes an extensive selection of series, an enormous list of movies from a range of genres, and more than 70 HD channels; a total of 8,000 hours of programming. In 2017, we achieved coverage to encompass 22 cities and more than 170,000 customers.

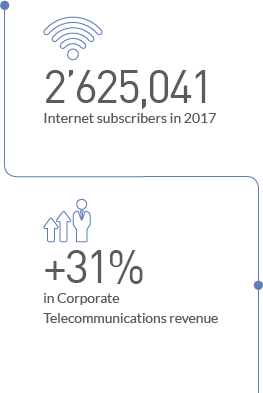

Internet

We continue reporting double-digit growth in this area thanks to our competitive advantage: offering our customers the best possible products and services at the fastest speeds and the lowest prices. In 2017, our subscriber base increased by 18% in a year-on-year comparison, reaching 2,625,041. Revenue from this business unit increased by 15%.

This market still represents a major growth opportunity, which is why we ensure we offer our subscribers the highest quality service and the best experiences, offering increases in Internet speeds from 5 to 10 Mbps and 10 to 20 Mbps at no extra cost. To the end of 2017, 53% of our subscribers had speeds upwards of 20 Mbps.

Telephony

Our business strategy has allowed us to maintained increases in this area despite the market contracting. This is the result of our continuing efforts to improve the best triple play proposals on the market.

In 2017, our sales strategy led to a 25% increase in subscribers compared to 2016, achieving a total of 1,466,535.

Corporate Telecommunications

This segment encompasses MetroCarrier, MCM and Ho1a, and represented a major part of the Company given its growing market share and positive results. In 2017, we successfully expanded our operations in Mexico City, Monterrey, Tijuana, Ciudad Juarez and Cancun.

In 2017, revenue from this segment reached MXN $2.354 billion, representing an increase of 31% in a year-on-year comparison. This segment currently represents 14% of our total revenue.

Revenue and Operating Margins

In a year-on-year comparison, we achieved an increase of 1%, reaching MXN $17.238 billion; however, excluding revenue from the CFE project, our Company grew by 7%, highlighting its continuing growth. This is the result of our excellent performance, both in the massive and corporate markets, thanks to our innovative products and attractive options for the market.

The EBITDA margin for cable operations was 46.5%, reaching MXN $7.149 billion, a 9% increase compared to 2016; while the Consolidated EBITDA margin increased significantly to 44.3%, reaching MXN $7.643 billion.

Balance Sheet

Megacable’s balance sheet reflects the strength of its operations, enabling it to continue generating cash and maintaining the lowest leverage in the industry, resulting in significant organic and inorganic growth potential.

Total assets reached MXN $35.978 billion to the end of 2017, representing an increase of 10% or MXN $3.403 billion in a year-on-year comparison. This increase is the result of on-going investments to improve our network, as well as cash generation for our operations throughout the year. Current assets represent 16% of the Company’s total assets.

Short-term liabilities reached MXN $3.879 billion, a 12% decrease compared to 2016, which is the result of the loan payment for the CFE project and the maturity of a USD $30-million commercial loan. This is the result of leveraging 0.12 times the Company’s EBITDA. Short-term liabilities represent 38% of total liabilities and 11% of total assets.

Total liabilities reached MXN $10.198 billion, a 9% increase in a year-on-year comparison, resulting from an MXN $1.7 billion loan that will mature in 2019. The company’s total equity increased by 11% in 2017 as a result of accumulated profits, reaching MXN $25.781 billion and continuing the double-digit growth trend of the Company’s book value.

Capital Investments

In 2017, total CAPEX investments reached MXN $4.693 billion, representing an 8% decrease compared to 2016. These investments have been earmarked mainly to expand the corporate network to provide coverage in new cities, the acquisition of terminal equipment for subscribers, the construction of new kilometers and the updating of our network.

We consider our network to be one of our main assets and one of our greatest strengths, which is why we continue to invest in increasing our capacity and making it more efficient. This is the result of the ever-changing panorama we operate in, mainly in terms of the habits of our subscribers. These investments help us to develop services that meet the expectations and requirements of our customers, in terms of content, quality and accessibility.

Our network currently covers 8.1 million homes and more than 56,000 kilometers, increases of 3% and 4%, respectively, compared to 2016. Our capital investments represent 27% of our revenue.

Market Performance

The Company’s operating and financial results had a positive effect on our share price (CPO), which stood at MXN $80.01 at the end of December 31, 2017, an annual increase of 15.3%. Furthermore, the Company’s market capitalization reached MXN $68.9 billion by the end of 2017, a 15% increase compared to 2016. As a result of this trend, in September 2017, our CPO was included in the Mexican Stock Exchange’s (BMV) market main index, which comprises 35 companies that meet a range of selection criteria, including market capitalization and trading history, increasing our share development possibilities on the market.

We have a total of 1.721 billion Series A shares, of which, to the end of December 31, 2017, there were 1.720 billion in circulation. We have a free float of 35%, with investors owning 600 million Series A shares, equivalent to 300 million CPO’s.

Human Capital

The way we work focuses on achieving results, which is why, from the recruitment process onwards, we ensure that our new employees meet the requirements of the Megacable family, helping them integrate easily into our family.

Thanks to this carefully monitored process, we have innovative and committed employees who can rapidly adapt to the demands of their surroundings. In 2017, we created 564 new jobs, representing a 3% increase in a year-on-year comparison, reaching a total of 18,513 employees.

Through our Employee Development Program, we offer education, training and certification opportunities. A clear example of this is the annual Megatec event, which is aimed at technology providers who want to share their experience and knowledge with our employees.

We also use 360° performance evaluations for our employees, in addition to workplace climate surveys, career development plans, and other activities that help us drive their growth within the Company and achieve numerous success stories.

The telecommunications market in Mexico still represents a major potential for growth, which is why we will continue to embody the values that have helped us achieve success. We will continue working and innovating to remain profitable, offering our customers the best products, outstanding service and the most attractive options available on the market through a robust strategy and the tools necessary to make this a reality.

Sincerely,

Enrique Yamuni Robles

CEO

Manuel Urquijo Beltrán

Secretary of the Board of Directors