with our customers

Interactions with Our Customers

Every single day, we listen to what our customers have to say in order to better understand their needs and preferences. This allows us to design business strategies that cover their expectations and ensure we make the best possible decisions relating to our financial services. Improving the quality of our services means improving their experience with us.

Customer Service

Customer satisfaction is synonymous with outstanding service, and because we firmly believe in this, we are characterized for offering a tailor-made, accessible, fair and innovative experience every time our customers use Santander services.

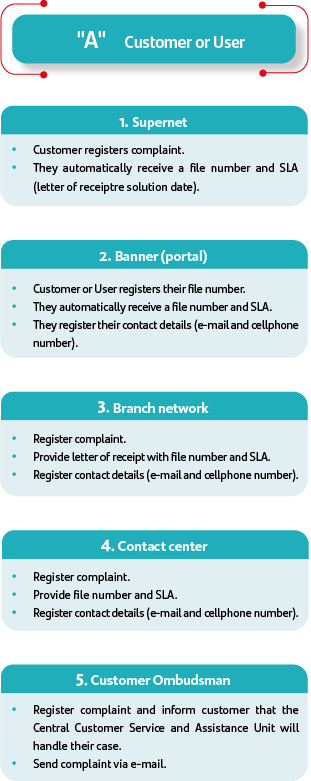

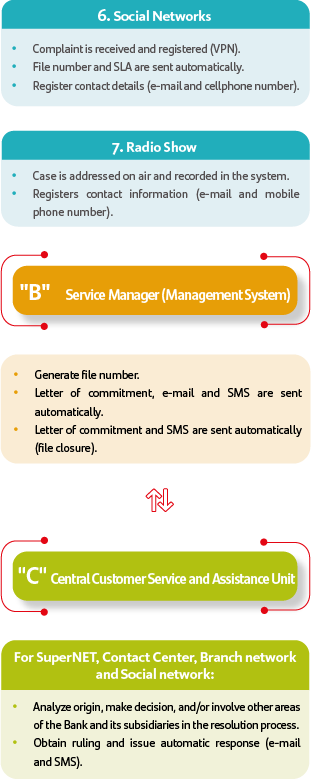

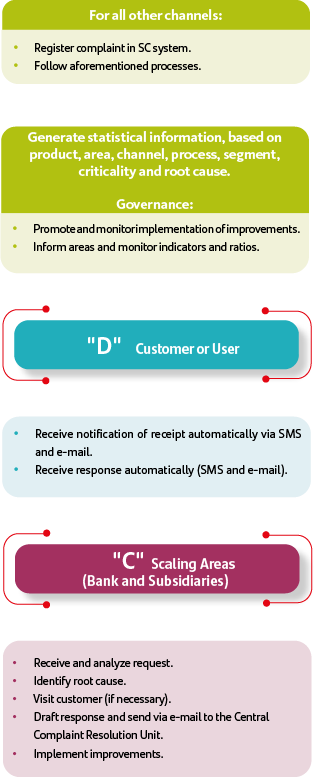

We have a Central Customer Service and Assistance Unit, which acts as our communication channel with customer and which comprises the following areas:

Customer Satisfaction and Quality

Our customers play a fundamental role in ensuring the prosperity of our business, and we have a number of support channels and strategies to help drive satisfaction levels. Our commitment lies in better understanding the needs of our clients and meeting them through the range of quality products and services we offer.

Emotional HUB

Our Emotional HUB, which we rolled out in 2019, allows us to create unique experiences for our customers. We work with a 7-step methodology to develop Customer Experience Improvement projects:

- 1. Data: discovery and data exploration phase.

- 2. Employees: research involving employees.

- 3. Customers: research involving customers.

- 4. eCJM: mapping of the customer experience based on research.

- 5. Initiatives: Design Thinking, creation and co-creation.

- 6. Classification and selection of projects based on the impact on the customers and ease of implementation.

- 7. Development and Measurement: implementation of initiatives. Definition and monitoring of KPI's.

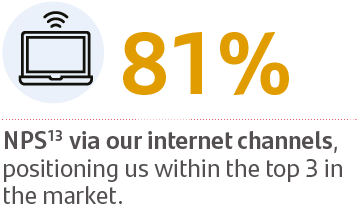

As part of our strategy to improve customer experience and learn more about their opinions, we use NPS (Net Promoter Score). During 2020, we monitored the NPS of our operations, channels and products, which has enabled us to better listen to our customers and have access to online data. This allows us to better monitor our performance in order to opportunely react to complaints made by our customers.

We also have a range of initiatives that meet the needs of each of our customers: mortgages, credit cards and tailor-made service at branches, among others.

Mortgage

We have improved our Mortgage customer service level by partnering with teams of brokers who provide direct assistance from specialists within the mortgage sector. We have also driven improvements in our factory processes, optimizing the time taken to assess applications and provide our customers with a response.

We have also incorporated WOW Experiences (a welcome kit and golden key when signing the mortgage) as part of our efforts to improve our customer relations and ensure their interaction with us is more memorable.

12. NetPromoterScore.

13. NetPromoterScore.

Credit Card

We mapped the Emotional Customer Journey, both in terms of face-to-face and online applications, in order to identify pain points, emotions, expectations and importance. We implemented a number of areas of improvement to boost the experiences of our customers when they use their cards, the goal of which is to optimize delivery, acceptance and rejection management when using it.

The Santander Touch

We have a procedure in place to offer each of our customers a unique experience when they visit our branches. Our employees participate actively throughout this process. Before opening the branch, they must make sure that everything is in its place before welcoming customers.

Our employees then welcome our customers, listening to them and resolving their problem before saying goodbye. To improve the customer experience, employees must find out the customer’s name and call them by it while helping them, identify the relationship they have with the Bank, make them feel part of the family, and, finally, invite them to use our digital channels.

We also drive awareness among each branch team through sessions, webinars, awards and direct communication.

The Santander Touch Awards

We present awards every quarter to each of our branches that obtain the highest NPS results in the ranking and the best NPS.

Santander Elite Awards

During the first two quarters of 2020, we organized two awards ceremonies for our top ten branches, presenting awards to 163 people. During the third quarter of the year, we presented awards to a further 115 people from ten branches.

Each member of the branch is presented with an insignia, a personalized diploma, WhatsApp stickers, and an Amazon gift card.

A course was also developed for Academia MX, and a series of webinars and training sessions about The Santander Touch/ NPS and their importance for the Bank were organized.

Branch Name Badges

As part of our efforts to improve customer satisfaction and service quality, we implemented the use of name badges at our branches in order to ensure that our customers were able to properly identify the person assisting them. Some 12,000 name badges were distributed throughout the country to branch employees. As a result of this measure, the number of customers mentioning the name of the employee who assisted them increased when answering surveys.

Training:

- • Online NPS course for new branch executives.

- • Training material for an induction course covering all areas.

- • Material for DNA (Passion for Service) with team training covering NPS.

- • Four corporate offices were “dressed” in NPS advertising.

- • Fixed screen at corporate offices displaying information about NPS.

- • On-going communication about NPS and detractors via screens at CCS.

- • Memos about NPS and its importance.

- • What is NPS and how is it measured? videos at Patio Santa Fe and corporate offices.

- • Every Monday an NPS indicator was published via the Intranet.

- • 30 Qualtrics training sessions.

- • 29 visits to branches to boost times and raise awareness about NPS.

We listened to the opinions of more than 650,000 customers through surveys, in-depth interviews, a focus group, facial coding and UX testing, among others, in order to learn more about their opinion of us and detect any areas of opportunity. We will continue redoubling our efforts to improve experiences for both our customers and our employees.

Experience for New Employees

To ensure that our new employees feel part of the Santander team from the outset, we focus on providing them with a number of experiences to make their time at the Bank a memorable one.

During their first day and as part of the induction process, we give employees their ID cards, offering them access to their place of work, canteen, parking and transportation, and they are accompanied by a Santander buddy at all times. They are made to feel welcome by being presented with a pin (My Workplace) and a video recorded by the President of the Bank, which they receive via e-mail.

The public health crisis of 2020 helped us evolve the way in which our employees undertake their day-to-day business activities, providing them with tools they can use via their cellphones to allow them to continue working from home. This model encompassed up to 96% of all of our employees.

A number of guides manuals explaining the guidelines that need to be followed by each employee as part of the remote working experience were developed, with the goal of guaranteeing business continuity and opportune and efficient customer service.

One of the priorities and measures that we implemented to minimize the impact on collections and recovery focused on organizing training sessions with the entire network team.

Our goal lies in promoting a work environment that is positive for our employees, allowing them to develop a sense of belonging to the Bank. Motivation is a key element for them as this is how they embody their commitment to our customers and offer the best possible customer service. Every single day, we strive to ensure that our employees feel part of Santander, and this can be clearly seen in the service that we offer our customers.

Installation of Redirectors

In order to promote transaction referrals to alternative channels, we installed redirectors, accompanied by a dividing screen that separates the main area from our teller windows. The goal is to increase privacy and security levels for our employees and our customers. In 2020, these were installed at 335 points (approximately 32% of the entire network), benefiting a total of 590 branches (57% off the network) through a smart model.

We also improved the quality of the customer service we offer at our branches, which can be clearly seen in the improvements to our recommendation KPI. We also improved the availability of the ATM’s and multifunctional ATM’s located at our branches through primary-level failure resolution protocols. The installation of these redirectors and counters help contribute to improving service times for customers at our branches.

Agile Model

We have consolidated our Agile Model, reaching a total of six operational points. These are found in areas with a high number of transactions and payroll numbers, reaching referral figures of up to 75%. This has helped us improve the quality of service we offer our customers at our satellite branches, helping drive business creation.

Work Café Online Talks

During the pandemic, Work Café created a customer service protocol, migrating the talks it offers to a digital format for both customers and non-customers. During 2020, a total of 78 talks were organized, 66 of which were made available online. These were attended by 89,000 people, mostly via Zoom or Facebook Live.

Accessibility

We are a responsible bank that promotes financial inclusion and strives to ensure that an increasing number of people have access to our financial services. We offer accessibility to our customers, covering basic banking transactions without having to visit a branch. We have achieved this through our correspondent banking network.

Inclusive Branch

We inaugurated our first Inclusive Branch, a new format that supports our elderly customers or those with a disability, facilitating their operations and time spent at the branch. It has spaces for wheelchairs, expanded waiting areas, special desks and windows for the customer and the person accompanying them, and even an area for service animals.