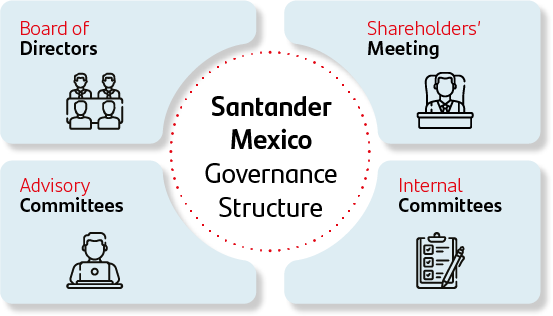

Our Corporate Government tasks with effectively safeguarding the interests of all our stakeholders, in addition to providing accurate and transparent information regarding the Bank’s performance and results. Our operations are aligned with the highest global sustainability standards, in addition to both local and corporate best practices.

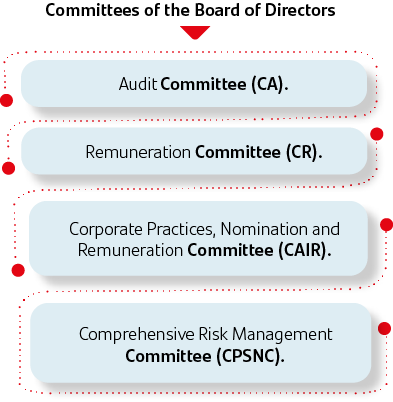

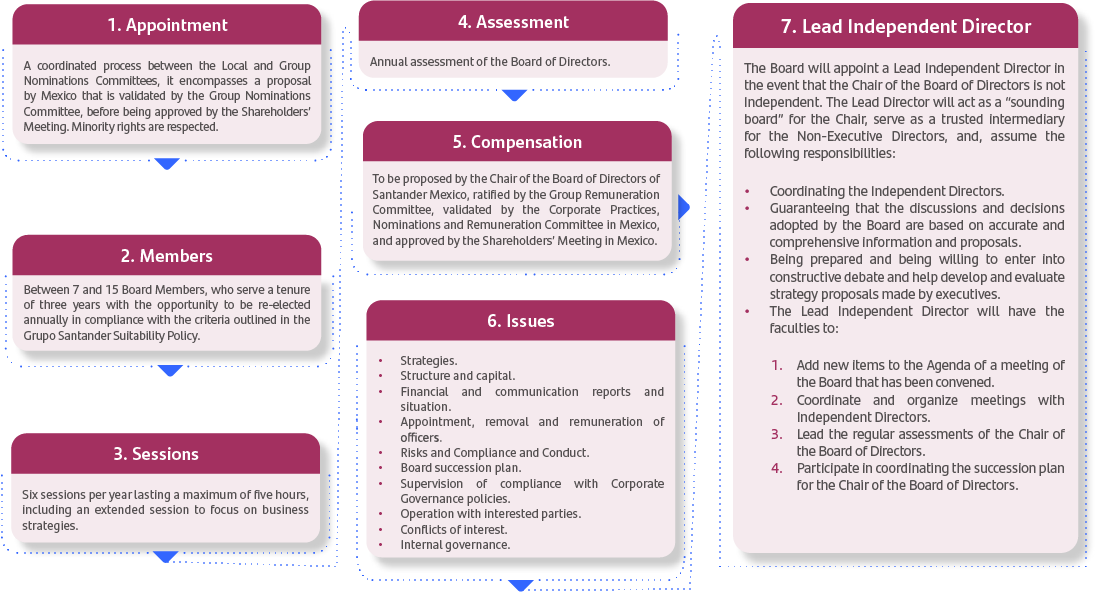

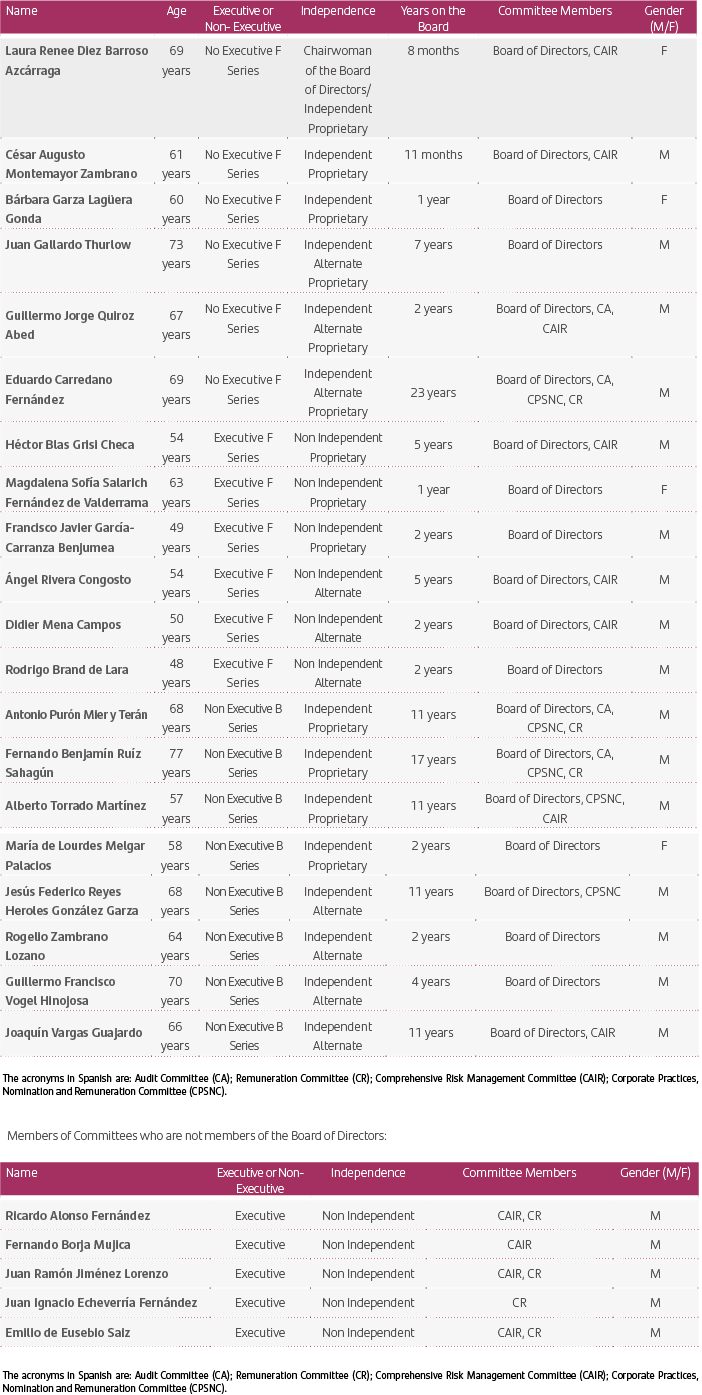

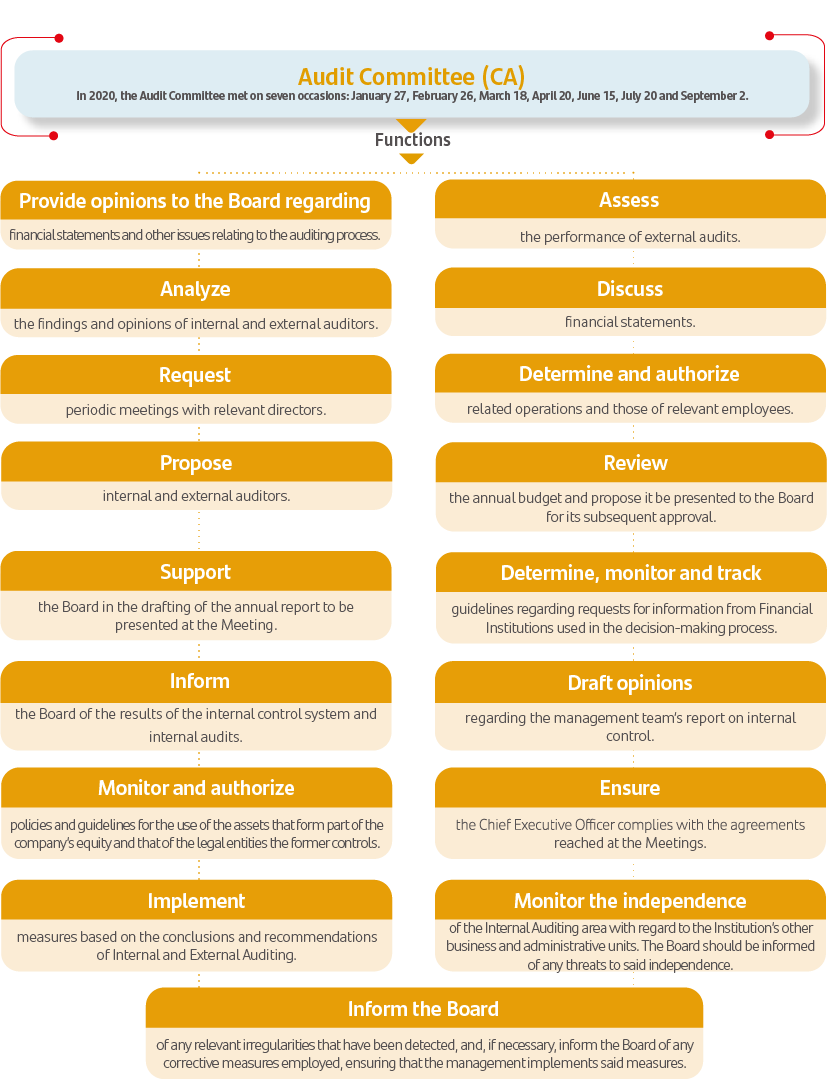

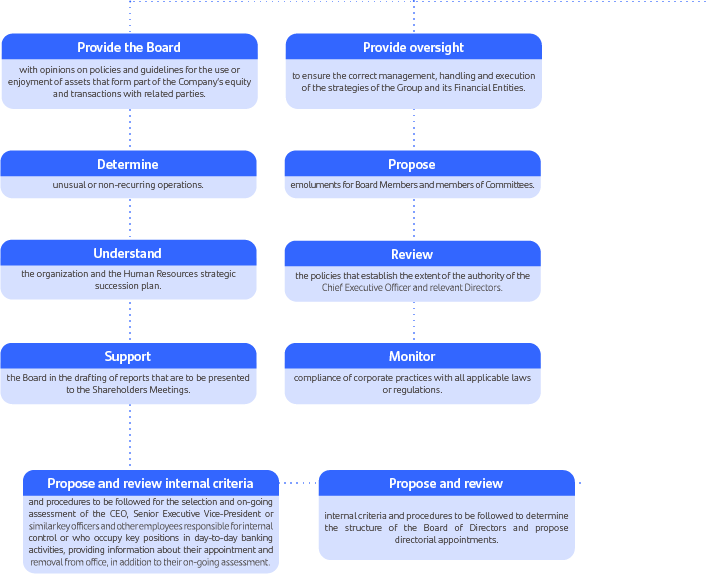

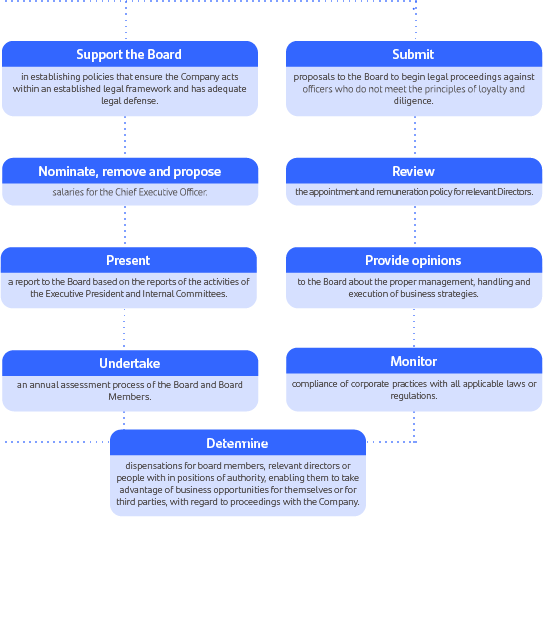

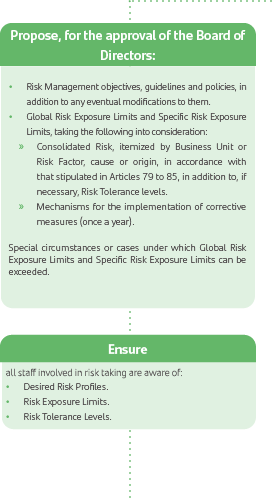

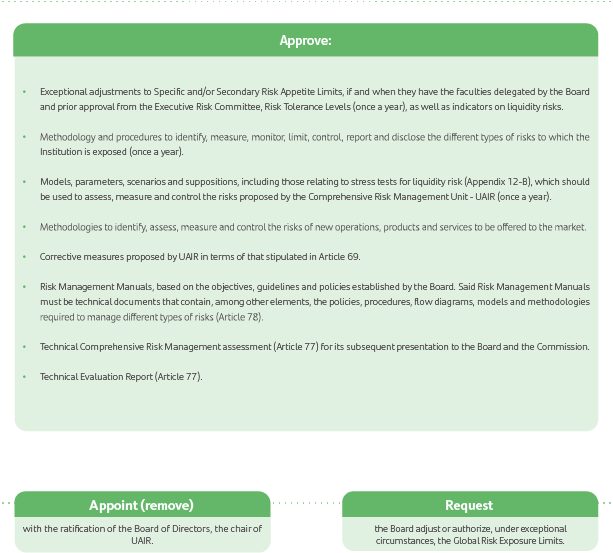

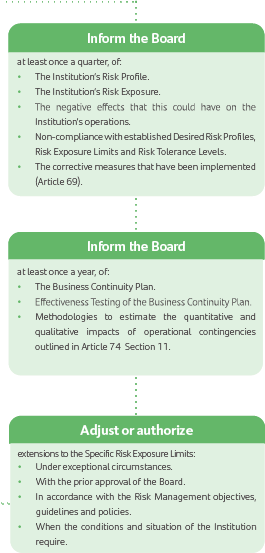

The Board of Directors and its Committees are responsible for monitoring, authorizing and reviewing all operations governed by Santander Mexico’s regulatory framework. They are also responsible for ensuring the company’s resources are used responsibly.