ethics

General Code of Conduct (GCC)

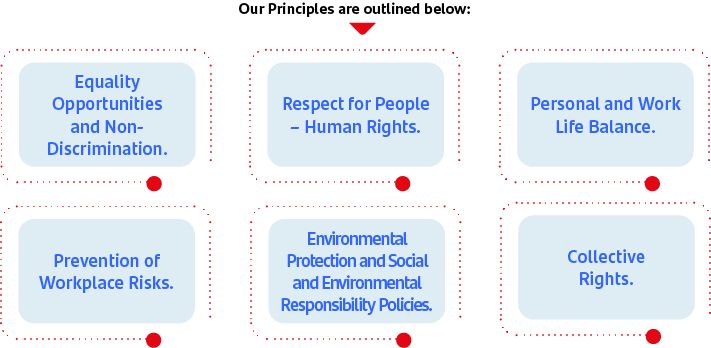

Our practices and behaviors are guided by a regulatory framework contained in the General Code of Conduct, which encompasses San- tander Mexico’s mission, vision and values. This series of ethical standards governs the way in which we operate and behave as a financial institution.

To guarantee that our employees act in a responsible and ethical manner, we offer comprehensive training regarding compliance with the General Code of Conduct (GCC) and Anti-corruption measures.

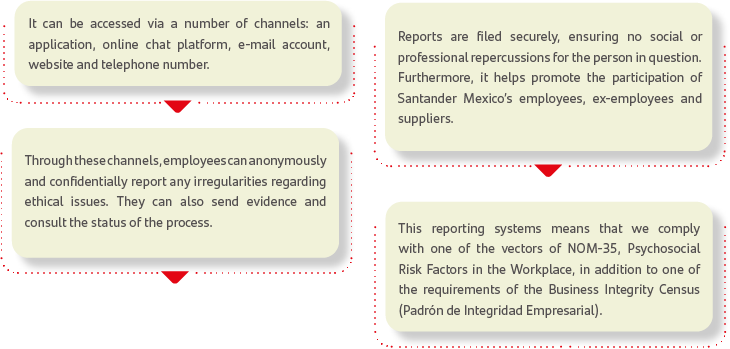

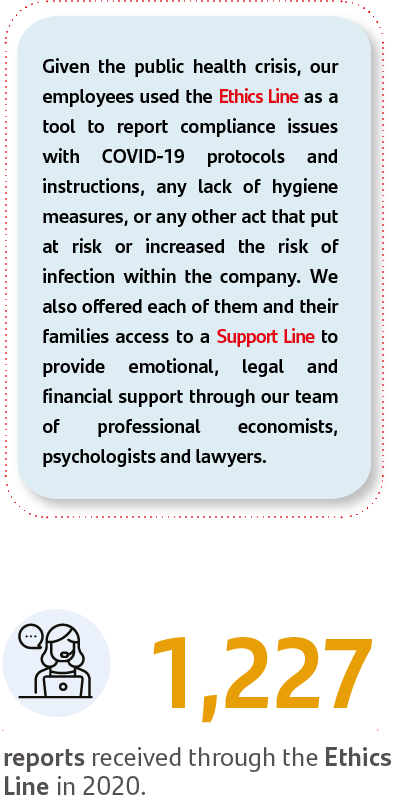

To safeguard the security and functionality of our practices and operations, we offer our employees access to our Ethics Line, a channel through which they can make their voices heard in the event of any issues of non-compliance with guidelines stipulated by Santander.

It is operated by EthicsGlobal, an external company, in order to promote trust among employees and avoid possible conflicts of interest.

Corruption Prevention

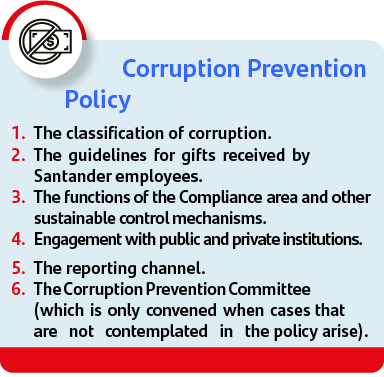

We promote honest practices and transparent operations among all Santander employees. We implement a number of strategies, such as accountability, which is a valuable tool to help combat internal corruption.

We strongly condemn any actions linked to illegal practices, such as the misuse of public funds, bribery, payment of contributions, influence peddling, or any other activity related to corruption. At Santander Mexico, our Corruption Prevention Policy is the standard through which we consolidate honest and transparent practices within the Bank and regulate anti-corruption measures, as well as the operations of the Compliance area and other relevant Committees.

We inform and train on our policies and procedures to help tackle corruption to:

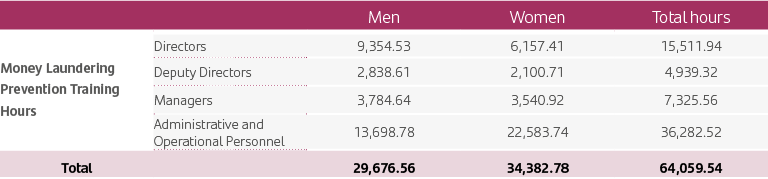

Money Laundering Prevention

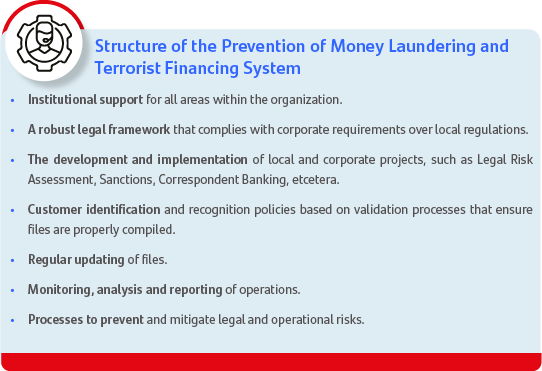

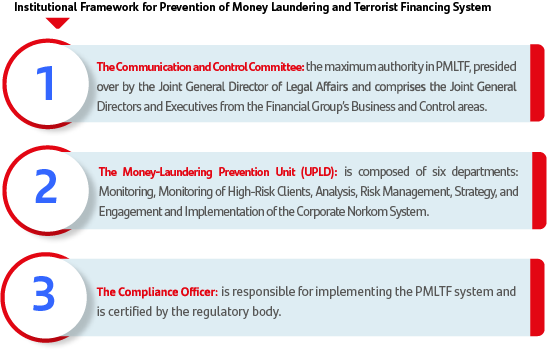

One of our major priorities is preventing money laundering within our operations, in addition to eradicating any activities relating to money laundering and, as a result, the financing of terrorism, which is why we have adopted a range of measures and procedures.

We have a System for the Prevention of Money Laundering and Terrorist Financing (PMLTF), which is governed by the General Policy and Procedures Manual and was designed to create policies, guidelines, regulations, flows and controls regarding funds.

This system is reviewed on an on-going basis to ensure compliance with domestic regulations. Furthermore, there is a risk and control certification program, which is implemented every six months.

Conflicts of Interest

All our operations are undertaken in compliance with the guidelines contained in the General Code of Conduct (GCC) in order to ensure our employees, directors and Board Members make the right decisions and always act in the best interests of Santander, without putting vested interests or those of family members or other acquaintances first that could affect the Bank or its customers in areas relating to the acquisition or leasing of goods and assets, transactions, and product and service contracts.

Furthermore, the Compliance area is responsible for receiving, identifying, analyzing and registering any acts that infringe the General Code of Conduct (GCC), and these are then sent to the Compliance Committee.