and inclusion

After the pandemic left her without work, Mercedes Cruz started her own business selling food door-to-door with her mother-in-law. Through Tuiio, we offered her a loan and financial education to help her start her company, El Sazón de Ángel, and begin generating income to look after her family.

"What we like most about Tuiio is the fact that they gave us a debit card that allows us to save, buy products and continue moving forward. Knowing that we have money on the card, I no longer feel worried. Without this loan, we would never have been able to get the business off the ground. We started at square one with that money. I would like to thank them for having helped us to build something and allowed us to look to the future."Mercedes Cruz,

Tuiio Customer.

SME Programs

Our goal is to become a leading player in helping people and companies prosper in Mexico because we know that achieving sustainable and inclusive growth is only possible by working together. This is why we offer a range of services to SME’s, helping them continue creating jobs and driving community economic development.

In order to help Small and Medium-sized Enterprises that are just starting out, Santander SME focuses on five major areas: Talent and Training, Employment, Internationalization, Connectivity and Financing.

We also loans that focus on social and environmental issues:

To help local SME’s grow, we support them in forging business alliances and relationships with some of our partners. We achieve this through international business support and outreach programs to offer Small and Medium- sized Enterprises the opportunity to export and import their products through the following programs:

Santander Trade: This service supports our customers in their efforts to expand internationally through access to information about the international market, global databases, international directories and tailor-made services.

International Desk: This center provides help in consolidating the international operations of our SME customers through our international network of commercial banks and up-to-date information regarding financial products.

SME Advance

We offer SME’s access to a series of online courses that focus on a range of topics. As a result of the pandemic, no scholarships were awarded for face-to-face courses given that this non-financial support migrated to a webinar-based program. The topics focused on covering questions of interest to our customers: an SME survival plan and the SME panorama in Mexico, among others.

Inclusive Economy

As part of our strategy to have a greater impact on the SME sector, we forged the following alliances:

Avanttia: It offers a cloud-based billing system that is accessible from any device with an Internet connection, allowing business owners to streamline their billing processes and ensure compliance with tax processes in Mexico.

Cívico: Through crowdsourcing, this digital service allows SME’s to map relevant local business information to identify and connect with potential customers, helping drive their joint economic development.

Santander SME Online Loan

As part of our efforts to streamline our processes, we now offer our SME and young entrepreneur customers the opportunity to request loans online. This has enabled us to accelerate customer response times from 48 hours to just 60 minutes after approval. We have two online loan models:

- • Crédito Simple for working capital, with terms of between 12 and 36 months.

- • Crédito Ágil for working capital, with a 12-month term.

This allows us to quickly and easily receive loan requests, assess the information received and determine if the applicant complies with all requirements.

a55: SME Loan Fintech

Since 2014, through our venture capital fund, Santander InnoVentures, we have invested in more than 30 companies to help support the growth of entrepreneurs and their businesses. In 2020, we invested in a55, a Latin American fintech that offers loans to SME’s underpinned by the companies’ revenues. This works through a technological platform that connects bank accounts, custody solutions, invoicing, payment methods, credit intelligence, and information about the companies’ revenues, in addition to offering portfolio management and control in real time.

SME Digital App

Santander Móvil PyMEs allows SME’s to make mass transfers and payroll and tax payments, in addition to providing them with a digital account and the cross selling of digital products.

SME Website

We created a new website that offers the best user experience (UX) through the incorporation of all the products that our SME area offers its customers.

Joint-Stock Companies (SAS)

In order to promote the SME Online Onboarding process, we forged a strategic agreement with the Ministry of the Economy, making us the first bank in Mexico to recognize companies that have been registered as Joint-Stock Companies (SAS).

This agreement was developed to promote the online creation of enterprises by young entrepreneurs in order to drive support for these companies from the financial sector. The goals of this model include:

- •Facilitating the opening of bank accounts for entrepreneurs that offer benefits from financial institutions.

- •Facilitating the operations of entrepreneurs by leveraging secure and simple technological models.

- •Driving the consolidation of companies by simplifying the paperwork associated with corporate life.

As a result of the COVID-19 pandemic, we supported SME’s through programs to help mitigate the impact of this public health crisis and overcome it. Some of these programs include:

Industry Debtor Support Program (PGAD)

In April 2020, we rolled out the Industry Debtor Support Program (PGAD) to help our customers during the COVID-19 pandemic. We forecasted that our credit portfolio will recover during the second quarter of 2021, focusing on sectors that could see faster recovery, such as is the case with the agribusiness, health, import/export (as a result of the USMCA), manufacturing and maquila sectors, among others.

Free Training for SME’s

In conjunction with Universidad Anáhuac and the Wahdwani Foundation, we offered free training to more than 3,000 SME’s through online webinars that covered topics such as digital transformation, human resources, and resilience, resources that are necessary to tackle the crisis stemming from the pandemic.

Financial Inclusion

Access to basic banking services is one of the key factors in driving economic development. That is why we are committed to guaranteeing that the most vulnerable sectors of society have access to quality financial services. These are services that have been adapted to the needs of each person and promote financial resource planning through opportune and effective financial education.

Microloans

Our goal is to have a sustainable and profitable social impact that drives economic growth and promotes financial inclusion. Through the microloans we offer entrepreneurs, we help contribute to making their businesses a success. This service is offered through our Financial Inclusion division: "Tuiio, Finanzas de tú a tú".

Tuiio offers financial products and services to low-income sectors in Mexico. The majority of its customers are women entrepreneurs who are not part of the formal economy and who are generally excluded from formal financial institutions.

The Tuiio customer support model currently comprises 83 branches and two kiosks, enabling us to directly support our customers, which helps drive engagement with them during the product sign-up process.

In order to offer financial and non-financial services to its customers, Tuiio focuses on four major areas:

- • Inclusive Growth.

- • Digital Revolution.

- • Accessibility.

- • Customer Protection.

All Tuiio customers have access to:

100% online and commission-free savings accounts.

A debit card that is linked to the account.

We measure the short-, mid- and long-term social impacts of Tuiio based on the generation of responsible and shared value.

Tuiio Employee Training

Our priority lies in offering the best services and support to our customers, which is why we train our employees to help them develop skills and know-how in areas dealing with finance and customer service, which are not only of use within a professional environment, but also on a personal level as well.

Tuiio Partnerships

CEOP Partnership for Economic Inclusion

Tuiio participates actively in forging partnerships to drive financial empowerment and inclusion. Among the working groups we are a member of is Project 365, which is part of the CEO Partnership for Financial Inclusion, a program in which Axa, MasterCard, PepsiCo and Unilever are also involved.

The Tuiio team also took part in international conferences, including the virtual conference entitled “Innovative Financing and Women’s Empowerment” organized by UN Women and the IE School of Global and Public Affairs, in addition to a panel entitled “Financial Inclusion: More Important Than Ever”, which was organized as part of the Fintech Americas Conference.

Tuiio Support - Federal Government Loans

Tuiio launched a support program for its customers as a result of the pandemic, including:

- • Extended payment deadlines

- • Displacements

- • Grace periods

- • Interest write-offs

The Mexican government launched a program to support a million micro-business owners affected by the pandemic, mainly focusing on those found in urban areas who have been affected by decreased activity as a result of precautions taken to halt the spread of the virus.

Through Tuiio, we manage a third of these beneficiaries, and, as a value-added service, we offer them the option to pay loans via the Tuiio Móvil app. We also developed Financial Education content for them, in addition to providing them with access to the digital Anúncialo Tuiio directory and an exclusive Tuiio that offers discounts and promotions.

Since its launch, this program has had a positive impact on 238,184 people directly.

Financial Education

Our goal lies firmly in support Mexican families, especially their youngest members, ensuring they have the information and tools they need to manage their resources properly and take informed decisions in order to improve their economic well-being.

The Bank has focused its financial education efforts on audiovisual resources and social networks, convinced, on the one hand, that this is an effective learning method, and, on the other hand, taking into consideration the fact that distance learning has become an essential tool during the COVID-19 pandemic.

The major actions undertaken in the area of financial education in 2020 include:

Sustainable Finances

As part of our Responsible Banking Agenda, we support sustainable financing, taking into consideration Environmental, Social and Governance (ESG) criteria. We focus on promoting projects that aim to benefit the environment and drive progress within society.

Green, Social and Sustainable Bonds

The funds from sustainable bonds are used exclusively to finance a combination of social and environmental programs, which are aligned with the Green Bond Principles and Social Bond Principles of the International Capital Market Association (ICMA).

To drive projects that have a positive impact on both the environment and society, we spearhead the issuing of sustainable bonds through Santander Corporate and Investment Banking (SCIB) Mexico. As part of these debt instruments, issuers provide us with relevant information and evidence of their projects, including:

- • How the resources have been used.

- • A report on investment percentages.

- • Results.

The Debt Capital Markets (DCM) division, which is part of SCIB Mexico, has participated on the local market using an ESG format in the following public transactions:

In conjunction with the Special Fund for Agricultural Funding (FEFA), we acted as a joint bookrunner to issue this bond, the goal of which is to finance projects that seek to drive environmental benefits associated with climate change: reduced GHG emissions, water savings, the decreased use of agrochemicals, improved working conditions, soil conservation, and better productivity.

This bond was issued to raise funding to finance sustainable initiatives that improve access to water and sanitation. The reference framework for this bond is aligned with the Green Bond Principles and Social Bond Principles, as well as the guidelines for Sustainable Bonds. It was rated by Sustainalytics as an independent third party.

This is the first corporate bond in Latin America and the Caribbean to be aligned with the SDG Impact Standards for Bonds from the United Nations Development Program (PNUD), verified by Pacific Corporate Sustainability (PCS), a company that is part of the Pacific Credit Rating Group (PCR). The net resources from this issue are earmarked for the financing of sustainable community development projects by Vinte in Mexico, aligned with the Vinte Sustainable Bond Reference Framework.

Fideicomisos Instituidos en Relación con la Agricultura (FIRA) announced the launch of its ESG Portal, which is the hub for its efforts to adopt sustainable goals. We have worked as a partner and consultant to help create this sustainability policy framework.

Efforts include the issuing of the first Gender-Equitable Social Bond in Mexico on October 19, 2020, to help drive the financial autonomy of women in the agricultural sector in line with international best practices. This offers women the opportunity to access resources from three categories: Financial Inclusion, Labor and Productive Initiatives, and Entrepreneurship.

Other Green Financing

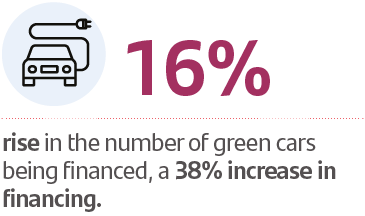

We offer a range of sustainable financing options, including for hybrid and electric cars. In 2020, we reached several milestones, and we will continue working on future projects that benefit both the environment and society.

Model Y

Since 2019, we have been working closely with Tesla, and we have positioned ourselves as the preferred financial institution for this major vehicle manufacturer in Mexico, driving innovation and sustainability by issuing more than MXN $100 million in loans for this brand’s electric cars. We are extremely proud to be supporting the arrival of the brand’s Model Y vehicle in Mexico, offering a special plan for auto loans.

Tesla’s Model Y is a mid-sized SUV that has caused high expectations among the Mexican market.

Green Car Plan

After just three years since issuing our first loan, we are now the second largest financer of green cars, and we offering exclusive financing for three vehicles brands, one preferred brand, and three motorcycle brands. We have issued 131 loans totaling MXN $114 million for green cars for brands such as Tesla, Volvo, Infiniti, Toyota, Land Rover/ Jeep and BMW, among others.