management

Risk Management Model

We have an institutional framework that guarantees the security of the Bank’s operations and its responsible behavior:

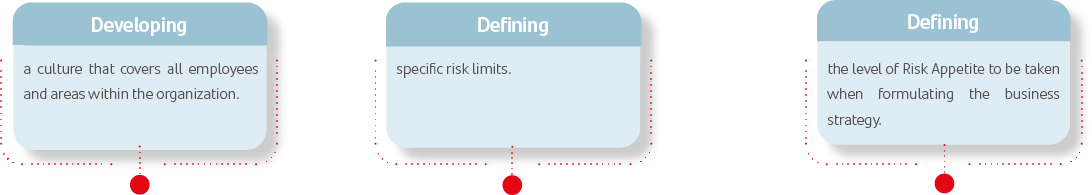

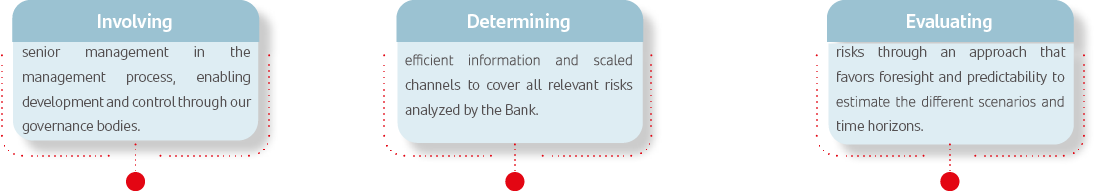

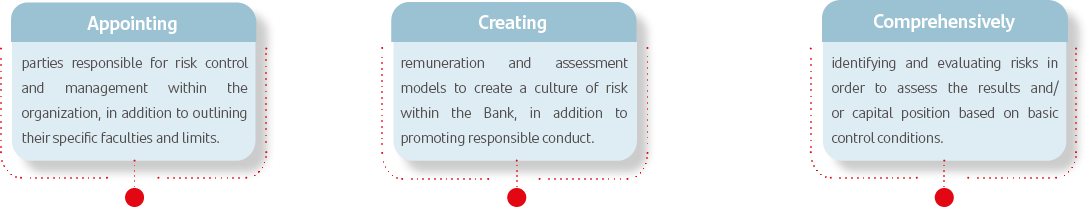

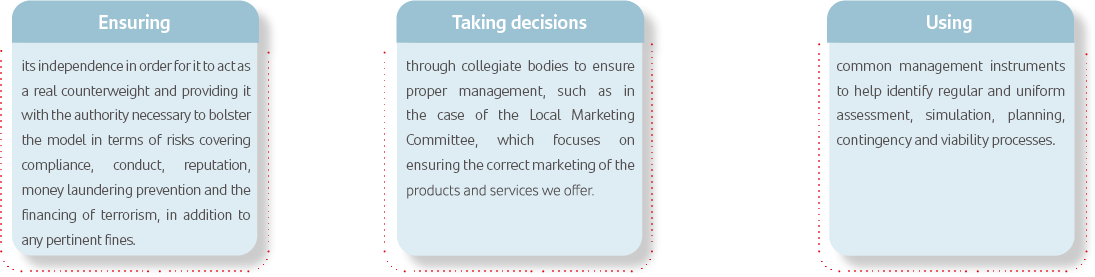

Principles of Our Risk Management Structure:

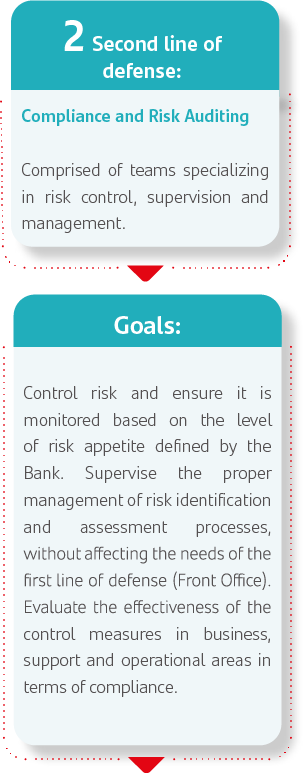

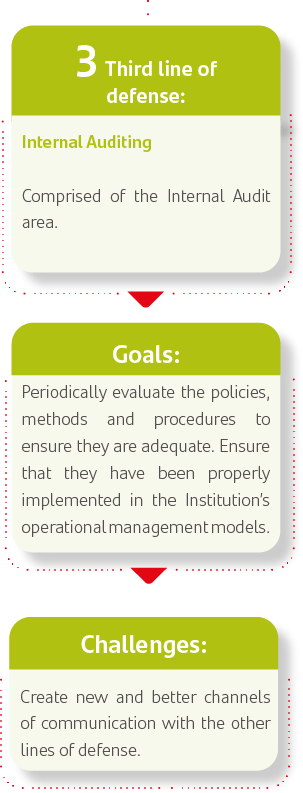

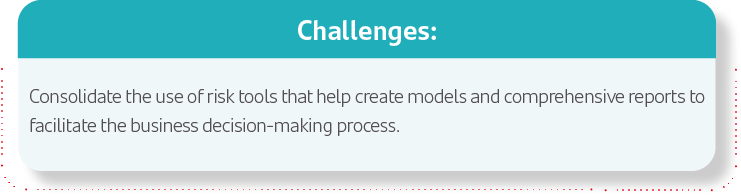

The Risk Management Model is coordinated by the Comprehensive Risk Management Committee (CAIR), which falls under the auspices of the Board of Directors. Below are the three lines of defense encompassed within this model:

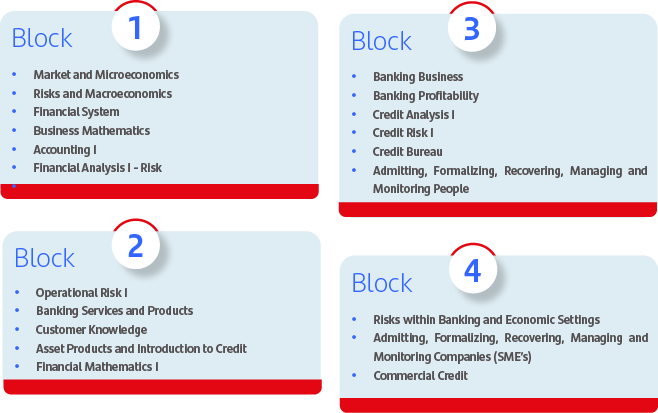

The School of Risk in Mexico is tasked with designing risk strategies and plans of action within our Bank, in addition to promoting a culture of risk among our employees. It publishes information through the following tools:

- •Knowledge Maps.

- •Risk Training Catalog.

- •Risk Programs.

- •Curricular Plans.

- •Technical, Functional or Case Study Awareness Sessions.

- •E-learning (Online Training).

- •Best Practices Workshops.

Thanks to our Risk Management Model, we maintain a medium-low and predictable risk profile to tackle the different types of risk that we face as a financial institution: credit, market, liquidity and financing.

Actions with the Culture of Risks

We promote responsible and ethical behavior through a range of initiatives that focus on all Santander employees.

We have an annual compensation model that assesses directors, managers and operational staff. We incorporate Risk Control Variables into this calculation in order to ensure coherence between our goals and all associated risks.

This calculation is based on five categories that encompass all major risks. Each category contains specific metrics that are weighted based on their importance.

- •Credit Risk

- •Market Risk

- •Operational Risk

- •Compliance

- •Audit

We use a technological platform to offer courses to all the Bank’s employees, including a Risk training program.

Furthermore, Human Resources has incorporated a series of risk management criteria into employee assessments. These criteria include:

- •Results of risk self-assessments: Each employee completes a self-assessment covering their management of risks throughout the year.

- •Percentage of compliance with management controls: This is the result of a Risk and Control compliance assessment (based on the area to which they are assigned).

We have also designed a plan to manage the culture of risks as an internal brand. Through marketing strategies aimed at people within the Bank, we have implemented a series of tactics, including campaigns, dynamic activities and promotions, in addition to collaborating with strategic areas to drive the visibility of the culture of risks among all employees, highlighting its fundamental role in our corporate culture.

We implemented a communication strategy based on the identification of “day-to-day” risks involving our risk management responsibilities, promoting the “we are all risks” culture and identifying our leaders as true risk managers.