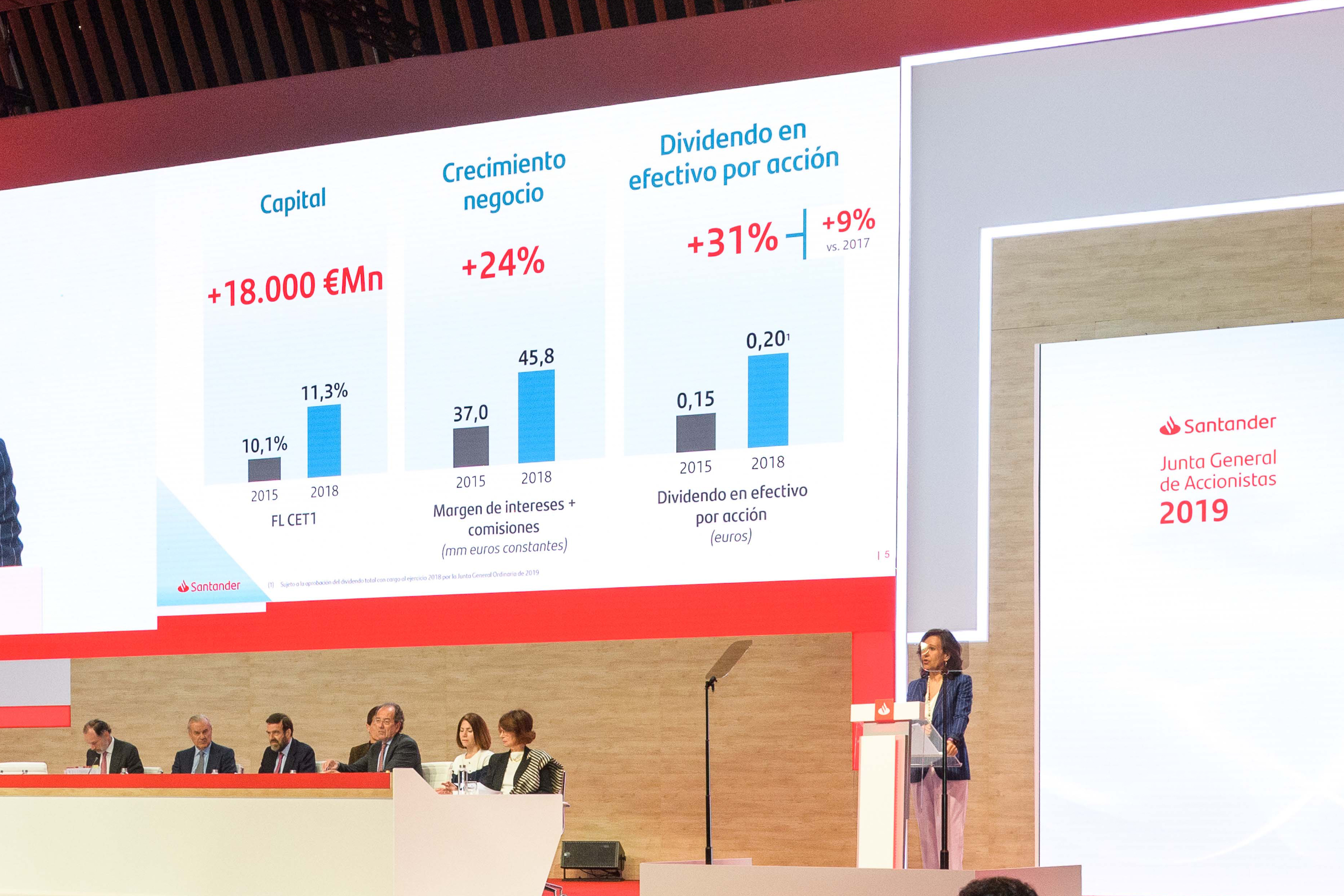

Banking (corporate)

“By delivering on our purpose, and helping people and businesses prosper, we grow as a business and we can help society address its challenges too. Economic progress and social progress go together. The value created by our business is shared - to the benefit of all. Communities are best served by corporations that have aligned their goals to serve the long term goals of society.”

Ana Botín

...Santander treats me responsibly

In our day-to-day business, we ensure that we do not simply meet our legal and regulatory requirements, but we exceed people’s expectat Simple, Personal, and Fair.

...Santander acts responsibly in society

We focus on areas where, as a Group, our activity can have a mahor impact on helping people and businesses prosper.

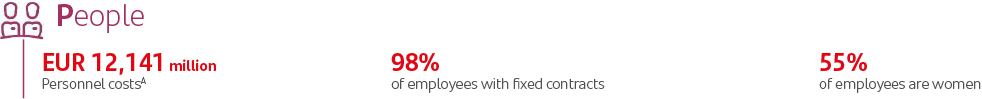

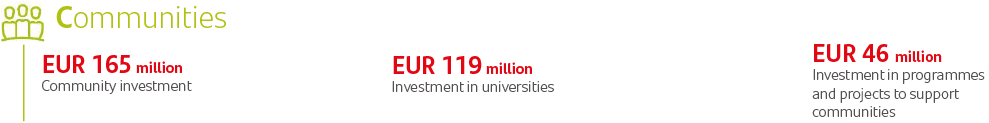

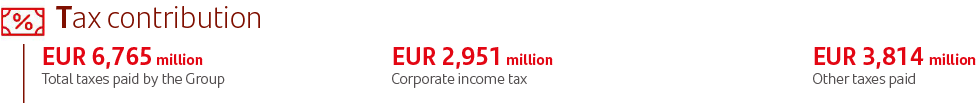

How we have helped people and businesses prosper in 2019

B. Including financial business activities and customer prepayments.

D. Data refers exclusively to purchases negotiated by Aquánima.

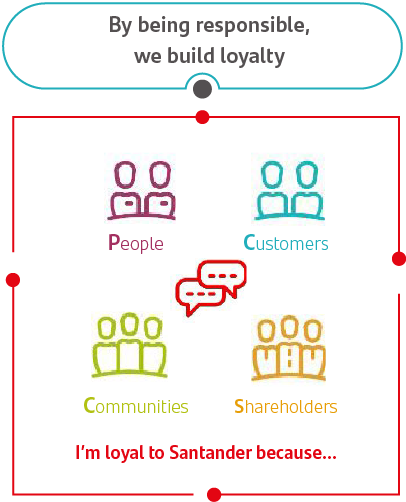

What our stakeholders tell us

To build a more responsible bank, we are

constantly engaging with and analysing the

views of all our stakeholders, so that we can

improve our performance and do more to

help people and businesses prosper.

How we engage

Earning and keeping people’s loyalty is key to creating lasting value. To do this, we must understand the concerns of all our stakeholders. By listening to their opinions, and measuring their perception of the Group, we not only identify issues, we also spot opportunities.

We encourage active listening and have several channels that enable us to understand stakeholders’ expectations. This ongoing dialogue is key to ensuring the success of the Group’s activities through the value chain.

As well as this, and to help us define and manage our responsible banking agenda, we also analyse what the leading environmental, social and governance analysts are telling us.

We are also continuously monitoring political and regulatory agendas in all markets where we operate.

We participate in consultations held by third parties about the impact the Group has on the sustainable development agenda. Furthermore, to understand our overall impact on society, we are always assessing social and environmental externalities (both negative and positive). This helps Santander to detect possible risks for business; and identify opportunities to create additional value for the society and ways in which we can protect the environment.

Finally, we are part of major local and global initiatives to support inclusive and sustainable growth, and help good causes in the markets where we operate. Details of these partnerships can be found on page 22 of this chapter.

Identifying the issues that matter

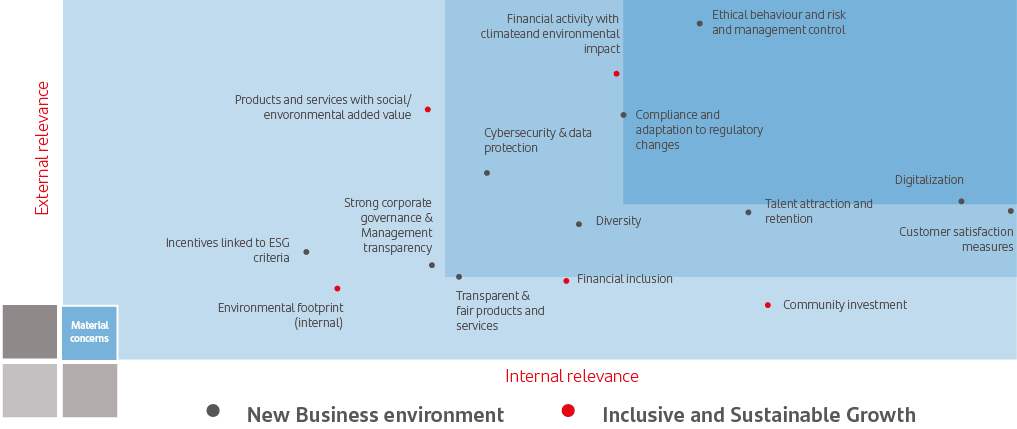

Santander regularly analyses the most relevant social, environmental and ethical behaviour issues through its materiality assessment. This systematic study is conducted across the whole Group’s value chain on an annual basis, and consists of an in-depth quantitative and qualitative analysis that uses information from both internal and external sources. Each of these inputs is weighted according to its relevance as regards defining material matters for the Bank. Weights are not distributed statically but are reviewed every year to adapt the study as much as possible to the current context and reality.

Based on this materiality assessment, a materiality matrix has been generated, where 15 material issues for the Bank have been identified as the most relevant issues. In 2019 we addressed the issues raised in a wide range of ways, as the following pages highlight. In particular, we focused on measures to embed responsible business practices; to tackle climate change and support the green transition; and to build a diverse and talented team.

Main inputs considered for the analysis

External

Shareholders (ESG investors; Rep risk)

Banking sector (Peers reporting and materiality analysis)

People (Customers surveys; Impact by business segment; Press Analysis; social networks)

Regulators (Regulatory & voluntary frameworks such us GRI, SASB or IIRC))

Internal

Santander Strategic view (Public Commitments, Internal communication messages, workshops, Top risk analysis)

Employees´perspective (employees’ surveys; interviews with local & global areas)

Executive perspective (Responsible Banking committees; Chairman and CEO messages)

Relevant aspects for the Group matrixA

This analysis helps us to focus our initiatives and programmes right across the Group.

Key issues in which we have put focus in 2019 (and what our stakeholder expect from us) |

Customer satisfaction measures | Mechanisms to control and manage the entity’s ethical behaviour and risks (fraud, corruption, terrorism, money laundering prevention tax evasion, etc.). |

|---|---|---|

| Diversity | Initiatives to promote the incorporation of women, persons with disabilities, ethnic or other minorities. | |

| Financial Inclusion | Initiatives to make financial services accessible for all,including those individuals and businesses with low incomes or no access to the formal financial system. | |

| Financial activity with climate and environmental impact | Strategy tackle to climate change and the transition to a low-carbon economy. Environmental impact derived from the Bank’s financing of certain activities. |

Challenges and opportunities

Like every business, Santander operates in a world that is changing fast, creating new challenges and opportunities. Using the results of the materiality assessment, we have identified two core challenges - the challenge of the new business environment, and the challenge of inclusive and sustainable growth.

The world’s economy continues to change fast. Advances in information technology and communications are transforming markets and business models. In this highly competitive environment, and in a time of rapid change, companies must work in new ways and have responsible business practices.

Santander, like all businesses, needs a motivated, diverse, skilled workforce that is able to deliver what customers want, harnessing the power of new technology. Meanwhile, we face new regulations and laws. These trends create the challenge of the new business environment in which we operate. Our task is to exceed our stakeholders’ expectations, to do the basics For more detailed brilliantly, every day. Key to this is having a strong information on our strategy to tackle this culture - a business in which all we do is Simple, challenge and turn it into an opportunity, please Personal and Fair.

Growth should meet the needs of today’s generation, without hampering future generations’ ability to meet their own needs: a balance should always be struck between economic growth, social welfare and environmental protection. Financial institutions can deliver this by managing their own operations responsibly, and lending responsibly to help society achieve its goals.

We can play a major role in helping ensure growth is both inclusive and sustainable. Inclusive: by meeting all our customers’ needs, helping entrepreneurs start companies and create jobs, strengthening local economies, improving financial empowerment, and supporting people get the education and training they need. Sustainable: by financing renewable energy, supporting smart infrastructure and technology to tackle climate change. We do this while taking into account the social and environmental risks and opportunities in our operations, and actively contributing to a more balanced and inclusive economic and social system.

Principles and governance

All our activity is guided by principles, frameworks and policies to ensure we behave responsibly in everything we

do. We have reformed and strengthened our responsible banking governance to help us manage initiatives which

tackle the two challenges we have identified.

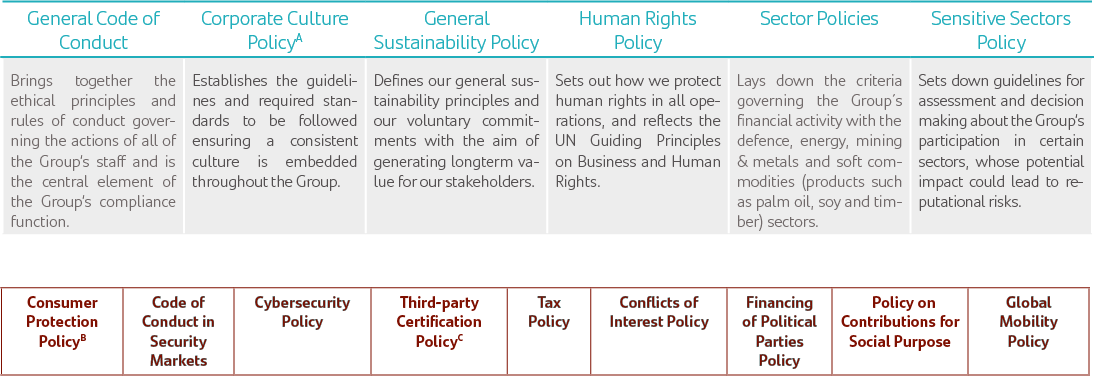

Policies that support our responsible banking strategy

B. Includes financial consumer acting principles.

C. Includes principles of responsible behaviour for suppliers.

Changes to policies in 2019

To make our policies easier to navigate, we have incorporated our climate change policy into ourGeneral Sustainability Policy. More detail on the governance of the policy has been included. The protected areas criteria has been aligned with the new Environmental and Social Sector Policy approach.

The Corporate Culture Policy has incorporated the Volunteering Policy. We have also updated our Diversity & Inclusion principles to reflect our commitment to people with disabilities and different sexual orientations; and to highlight the importance of having appropriate, accessible products for all. Our Leadership Commitments have been included under our Santander Way minimum standards.

TheHuman Rights Policy has been amended to update the main declarations and codes on which it is based. It also gives further specifics on relevant issues regarding our relationships with customers, suppliers and communities; and more detail on the policy governance.

Strategic overview and coordination

Governance

The responsible banking, sustainability & culture committee assists the board of directors in fulfilling its oversight responsibilities with respect to the Group’s responsible banking strategy overall. It focuses on corporate culture, ethics and conduct; the impact of digital transformation on our working practice; the Group’s policies on sensitive issues and sectors; and how the Group delivers inclusive and sustainable growth.

The committee is supported by the culture steering group and the inclusive & sustainable banking steering group.

- • The culture steering, promotes, supports and tracks the implementation of The Santander Way (our corporate culture) across the geographies, ensuring corporate and local actions are consistent.

- • The inclusive & sustainable banking steering reviews and tracks initiatives to tackle social and financial inclusion; extend and improve access to education and training; support by financing in the transition to a low carbon economy; and support investment which benefits society as a whole.

Responsible Banking network

- • La unidad corporativa de Banca Responsable coordina e impulsa la agenda de banca responsable. Para dar apoyo a esta unidad, Santander cuenta con un asesor senior sobre prácticas empresariales responsables, que depende directamente de la presidenta.

- • The corporate Responsible Banking unit coordinates and drives the responsible banking agenda. Supporting this unit, Santander has a Senior Advisor on Responsible Business Practices, who reports directly to the executive chairman.

Coordination and strategy

- • Metrics and targets have been established to drive Santander´s Responsible Banking agenda and embed Responsible Banking into the heart of the Group’s business strategy.

- • Guiding principles have been developed for subsidiaries (and global business units) to ensure the governance and implementation of our responsible banking agenda is embedded across the Group as a whole.

- • There is regular coordination between business units, including joint meetings held every two months. Additionally, the first Responsible Banking workshop, attended by Responsible Banking representatives from across the Bank’s businesses and geographies, was held in 2019.

- • Approval of our Responsible Banking priorities for the next cycle, 2020-2022.

- • Launch of Responsible Banking commitments for 2021 and 2025.

Responsible Banking strategy

- • Leadership Commitments have been included underThe Santander Way.

- • Global simplification initiative has been launched, nominating the responsible people and setting main indicators: Global Engagement Survey (GES), Net Promoter Score (NPS), Simple, Personal and Fair perception (SPF).

- • New globalmaternity and paternity minimum standards created.

- • New initiatives launched to increase recruitment of people with disabilities.

- • Signed up to the UN Women´s Empowerment Principles.

- • Update of Corporate Culture Policy.

- • Update of Human Rights Policy.

Challenge 1. The new business environment

- • A new climate change strategy created.

- • A new Global Sustainable Framework for the issuance of Green, Social and Sustainable Bonds created.

- • Updated environmental & social policies.

- • A financial empowerment and inclusion action plan created.

- • A new approach taken to responsible banking at Santander Wealth Management and Santander Corporate Investment Banking

- • New Santander Group Energy Efficiency and Sustainability plan to reduce our internal environmental footprint.

- • New commitment made to become carbon neutral in 2020.

Challenge 2. Inclusive and sustainable growth

Main international initiatives we support

At Group-level, we work with a number of initiatives and working groups at local and international level to drive forward our agenda on responsible banking. These include the following:

UNEP Finance initiative.

We are a founding signatory of the

United Nations Principles for Responsible Banking. We also

participate along with other 15 banks in the UNEP FI pilot project

on implementing the TCFD recommendations for banks.

World Business Council for Sustainable Development (WBCSD).

Our president, Ana Botín, is a member of the executive committee.

And we participate in the WBCSD Future of Work initiative, by

looking into how to adapt our own business and human resource

strategy to evolve with the digital age.

Banking Environment Initiative (BEI).

We participate in two

climate related work streams, the Soft Commodities Compact

and the new initiative Bank 2030, which aims to build a roadmap

for the banking industry to 2030 seeking to increase the financing

to low carbon activities.

• CEO Partnership for Financial Inclusion.

We, along with other

nine companies are part of a private sector alliance for financial

inclusion, an initiative promoted by Queen Maxima of the

Netherlands, Special Representative of the United Nations to

promote Inclusive Financing for Development.

Equator Principles.

We analyse the environmental and

social risks of all our financing operations under the scope

of the Equator Principles and we actively participate in the

evolution of a common criteria.

In addition, during 2019 we took an active role in the climate change and sustainable finance policy debate, participating in the formal consultation process on relevant regulatory files (particularly in Europe) and industry forums focusing on the transition to a low carbon economy. We have worked very closely with trade bodies - including the Institute of International Finance, European Financial Services Round Table, the Association for Financial Markets in Europe, and the European Banking Federation - to reach common positions on issues so relevant as the EU framework for identifying sustainable economic activities (the so-called taxonomy), and the ongoing work on the technical criteria undertaken by the TEG; the disclosure regulation relating to sustainable investment and sustainability risks; or the ongoing work on the identification and management of climate-related risks. In addition, Santander is participating in the EBF-UNEP FI working group that will develop voluntary guidelines for banks on the application of the EU taxonomy.

Helping us to address today´s main global challenges: 2030 agenda

We want to do more every day to promote inclusive, sustainable growth and ensure that we are actively tackling climate change.

Our activity and investments help us to contribute to a number of the United Nations’ Sustainable Development Goals, and support the Paris Agreement’s aim to combat climate change and adapt to its effects.

Main SDGs where Banco Santander’s business activities and community investments have the most weight.

We are committed to reduce poverty and strengthen the welfare and local economy of the countries in which we operate. Through our microfinance products and services and our community investment programmes we empower and help millions of people each year.

We are at the forefront of support for higher education. Through Santander Universities, a pioneering programme and the only one of its kind in the world, we support universities and students to prosper, focusing on education, entrepreneurship and employment. Santander Scholarships is one of the largest scholarship programme financed by a private company.

We promote an inclusive and diverse workplace. Ensuring equal opportunities and fostering gender equality at all levels is a strategic priority for us. Additionally, we also operate a number of initiatives to support diversity in our business activity.

We have a long history of leadership in the financing of renewable energy projects. Actually, we are the global leader in renewable energy financing. Additionally, we support our customers financing energy efficiency projects, low-emission, electric and hybrid vehicles, and other electric mobility solutions.

We have a prepared and committed team that allows us to respond and meet the needs of customers, help entrepreneurs to create businesses and employment, and strengthen local economies.

We develop products and services for the most vulnerable in society, giving them access to financial services and teaching them how to use these in an appropriate way to manage their finances in the best possible way. We have continued to support diversity and inclusion in our business.

We finance the construction of sustainable infrastructure that guarantees basic services and drives inclusive economic growth. Additionally, we also promote affordable housing opportunities.

We promote sustainable consumption both in our own operations as well as with our customers, offering our products and services that are Simple, Personal and Fair, and promoting ethical behaviours among our suppliers.

We tackle climate change in two main ways: by reducing our own environmental footprint and by supporting our more than 144 million customers to help them transition towards a more sustainable economy.

We participate actively and we are part of the main initiatives and working groups at local and international level as an important way to manage our responsible banking agenda.

2019 highlights

We work to have a strong corporate culture – a skilled, motivated and diverse workforce that can deliver solutions to our customers’ needs: increase access to finance; improve financial resilience through education and training, and supporting our customers in their transition to the green economy, while reducing our environmental footprint. Meanwhile, we create new opportunities by supporting education through our Universities programme and improving lives in the communities where we operate.

Our aim was to create commitments that were SMART: specific, measurable, achievable, realistic and time-bound. The commitments also reflect the ways in which our business can address the United Nations’ Sustainable Development Goals most relevant to our operations; and our support for the Paris Agreement’s aim to combat climate change and adapt to its effects.

2 Senior positions represent 1% of total workforce.

3 Calculation of equal pay gap compares employees of the same job, level and function.

4 People (unbanked, underbanked or financially vulnerable), who are given access to the financial system, receive tailored finance and increase their knowledge and resilience through financial education.

5 Includes Santander overall contribution to green finance: project finance, syndicated loans, green bonds, capital finance, export finance, advisory, structuring and other products to help our clients in the transition to a low carbon economy. Commitment from 2019 to 2030 is 220Bn.

6 In those countries where it is possible to certify renewable sourced electricity for the properties occupied by the Group.

7 People supported through Santander Universities initiative (students who will receive a Santander scholarship, will achieve an internship in an SME or participate in entrepreneurship programmes supported by the bank).

8 People helped through our community investment programmes (excluded Santander Universities and financial education initiatives).

- • Signed, as a founder member, the United Nations Principles for Responsible Banking, created to use the power of finance to tackle the major challenges that societies face, and support the UN Sustainable Development Goals and the Paris Climate Agreement.

- • Signed the Collective Commitment to Climate Action, which sets out concrete and time-bound actions that banks will take to scale up their contribution to and align their lending with the Paris Climate Agreement.

- • Analysed part of our portfolio’s alignment to climate scenarios, as a step towards addressing the recommendations of the Task Force for Climate-related Financial Disclosures.

- • Launched Santander Sustainable & Green Bonds Frameworks and issued a €1 billion green bond, starting our global sustainable debt plan.

- • Launched a new Green Bond investment fund that completes Santander Asset Management sustainable range, exceeding EUR 1,500 million of assets under management.

- • Joined the United Nations’ CEO Alliance on Global Investors for Sustainable Development (GISD) to help scale up long-term investment in sustainability development.

- • Joined the International Wildlife Trade Financial Taskforce as a part of the Group’s commitment to the prevention and deterrence of wildlife trafficking.

…while promoting inclusive and sustainable growth......

- • Updated the Corporate Culture Policy , which now incorporates our Leadership commitments under The Santander Way, our updated principles of Diversity and Inclusion, and integrates the Volunteering Policy.

- •Approved global parental leave minimum standards, which includes minimum period of 14 weeks paid for primary maternity/paternity leave and 4 weeks in a row or divided into periods of 15 days for seconday maternity/ paternity leave.

- • Launched Canal Abierto, a new way for employees to report breaches of the General Code of Conduct and actions that do not reflect our corporate behaviour.

- • Launched new customer feedback techniques in Portugal and Mexico, so we can improve our products and services.

- • Developed corporate guidelines for good practices on treatment of vulnerable customers, so we can cater for their individual needs and help prevent over-indebtedness.

- • Opened our new corporate Cyber Security centre to protect Santander, our systems and customers from cyber threats.

- • Integrated new ESG criteria into suppliers’ certification process.

- • Signed the UN Women’s Empowerment Principles.

- • Signed ‘The Valuable 500’. Commitment to put inclusion of people with disabilities on our board room agenda.

... and we have continued to address the challenge of the new business environment......