As a major part of social responsibility efforts within the Risks department, we created Risk Pro Charity, an employee initiative that aims to help socially disadvantaged people by working directly with a range of institutions that form part of Fideicomiso Por los Niños de México. In 2019, 8 programs were implemented, with a total social investment of MXN $1.4 million and benefitting 421 people.

Management

Risk Management Model

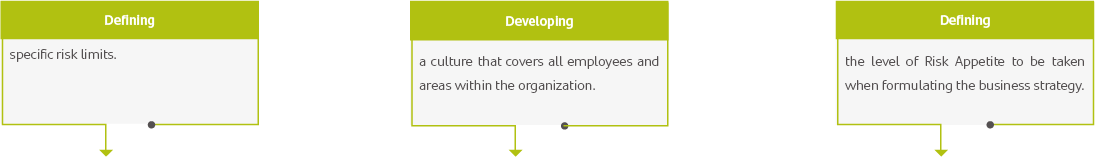

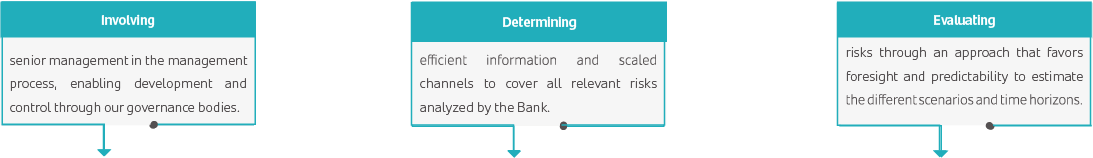

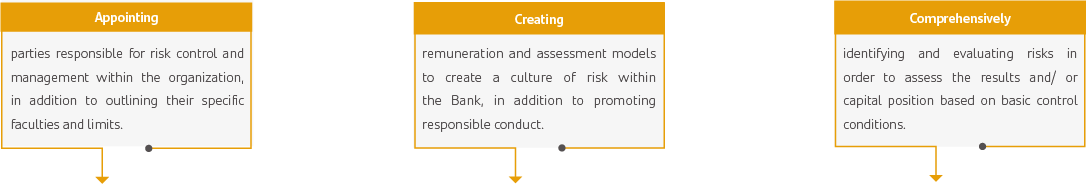

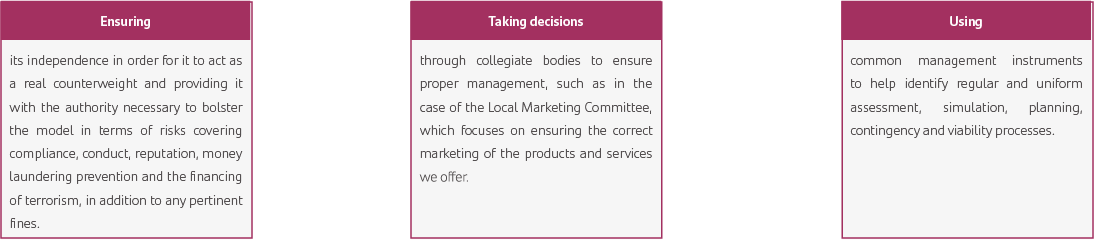

The Comprehensive Risk Management Committee (CAIR), which falls under the auspices of the Board of Directors, is responsible for coordinating the Risk Management Model.

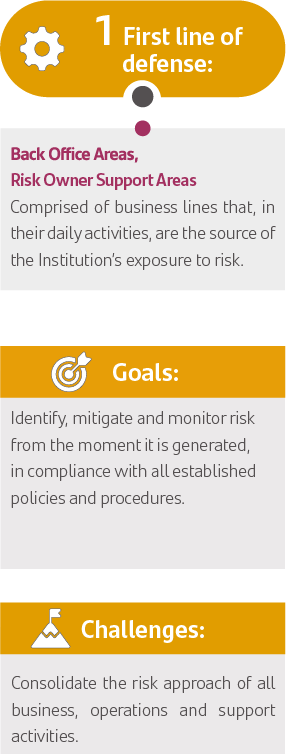

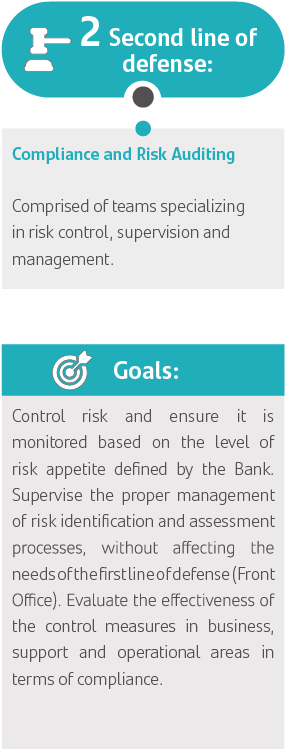

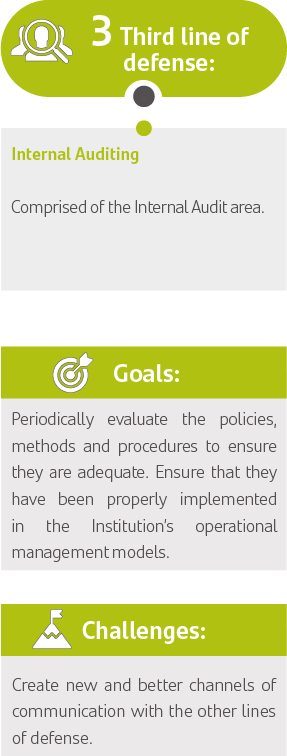

This Model encompasses three lines of defense, which are outlined below:

There are different types of risk in the banking sector, especially those relating to credit, market, liquidity and financing; however, through this Risk Management Model, we ensure a mid-low, predictable risk profile.

We also have a School of Risk in Mexico, which is tasked with designing risk strategies and plans of action within our organization.

This body is also responsible for publishing information regarding the culture of risk through the following tools:

- •Knowledge Maps.

- •Risk Training Catalog.

- •Risk Programs.

- •Curricular Plans..

- •Technical, Functional or Case Study Awareness Sessions.

- •E-learning (Online Training).

- •Best Practices Workshops.

Actions within the Culture of Risks

The culture of risks is not specific to the bank, rather it is a way in which we can safeguard that which we are interested in through ethical and responsible behavior underpinned by common sense.

Our main initiatives in 2019 were:

-

Risk Pro Charity

-

Semana Santander- Risk Pro

- •Risk Profiler: a fun quiz that, based on employee answers, tells them what their risk profile is, using an analogy relating to a breed of dog.

- •Culture of Risks Awareness: a series of activities was organized, focusing on 5 different areas: fraud, cyber risk, socio-environmental risk, Comprehensive Risk Management, and cultural transformation.

- •Risk Rooms (escape rooms): employees were challenged to discover key risk-related messages every day.

-

Advance Risk Management 2019

By corporate request, 21 programs were identified, focusing on local and global milestones for Advanced Risk Management (ARM – a program to accelerate the implementation of strategic projects to improve the capacity to manage and control risks) in order to help align the guidelines to the Bank’s risk strategies. The DGA has reported advances in keeping with the roadmap, estimating an advance of 98% for ARM and 91% for Risk Strategy to the end of the year.

-

Cycle of Conferences

Through conferences, risk directors provide information about the responsibilities of each area and how each employee participates in these processes.

-

Risk Pro Branch Certification

This internal certification recognizes risk management excellence by branch employees. To select these offices, Risk Pro takes the IGR into account, an index that catalogs branches based on metrics that measure risk management.

-

Visual Positioning Campaign

A graphic element was added to our corporate brand, Risk Oro, and at the corporate headquarters in Santa Fe, yellow Risk Pro Zone banners were put up, in addition to a digital campaign that included a range of messages dealing with specific risk management activities for central areas, BEI and branches.

-

Senior Management Commitment Campaign

Part of the principles of the culture of risk, Risk Pro, requires the commitment by senior management to these behaviors, making them ambassadors and promotors of these behaviors within their own teams. This is why we coordinated a campaign in which each department sent a personal e-mail to all members of their teams . To promote this commitment, a video was also made that included the participation of all departments.

“Risk Pro Charity is a team activity that we coordinate within the Risk Department, the goal of which is to create programs that have a social impact that benefit communities and people who are socially and economically disadvantaged.

Alongside other areas that have collaborated with Risk Pro Charity programs, we share the commitment to our company’s mission regarding the progress of people; our business must always be conducted responsibly.

Managing risks and having a positive impact on society is everyone’s responsibility.”Ricardo Alonso Fernández

Chief Risk Officer.