Ethics

General Code of Conduct (CGC)

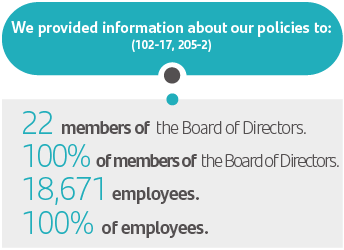

Santander’s General Code of Conduct (CGC) is our highest legal framework. It includes the principles, values and regulations that govern our way of operating.

Equality Opportunities and Non-Discrimination.

Respectfor People – Human Rights.

Personal and Work Life Balance.

Prevention of Workplace Risks.

Environmental Protection and Social and Environmental Responsibility Policies.

Collective Rights.

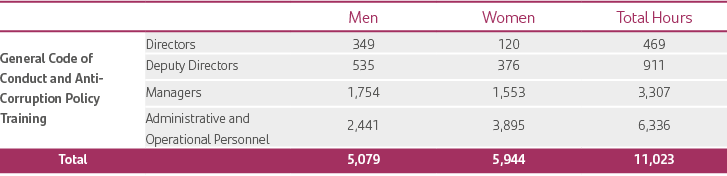

Training our employees in business ethics is of crucial importance to the Bank’s operations. This is why we offer comprehensive training regarding the application and specifications of Santander’s Anti-corruption Policy and General Code of Conduct.

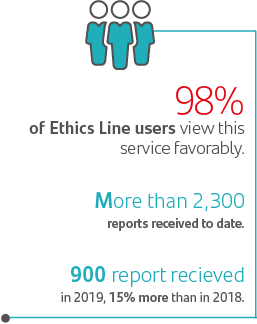

It is a secure system that promotes the participation of Santander Mexico’s employees, ex-employees and suppliers while ensuring no social or professional repercussions for those filing reports.

With our Ethical Line we comply with one of the vectors of the Norm 035 of Psychosocial risk factors at work and with one of the requirements of the Business Integrity Registry of having this type of complaints system.

Culture of Ethics

Our sense of business ethics lies in the embodiment of Santander’s values and principles by everyone at the organization. Throughout our history, we have forged and consolidated a culture of ethics that has allowed us to position ourselves as a responsible bank.

We have a channel through which our employees can report any ethical issues regarding Santander’s operations.

Our Ethics Line, operated by EthicsGlobal, offers a means of anonymously and confidentially reporting any misconduct or irregularities through easy-to-use channels, including an application, online chat platform, e-mail account, website and telephone number.

Feedback and monitoring processes to help promote best practices among directors.

Dismissals as a result of mistreatment or misconduct.

Interventions at workplaces to identify and improve the working environment.

Effective fraud prevention.

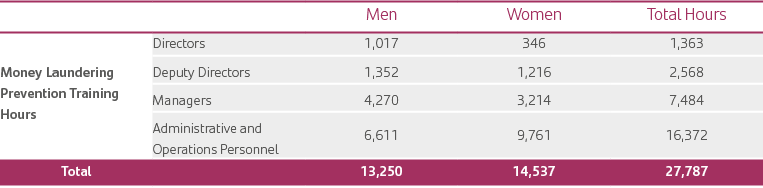

Money Laundering Prevention

Without a doubt, a major priority in business ethics is preventing money laundering and terrorist financing. To tackle these issues, we have procedures that help us eradicate any activity that hides information about the sources of funds.

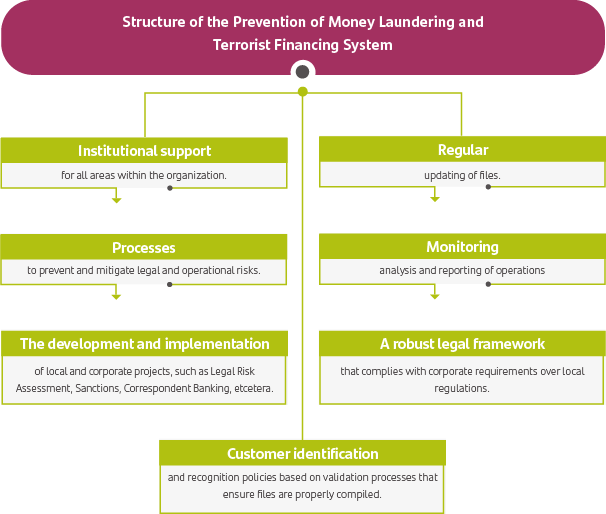

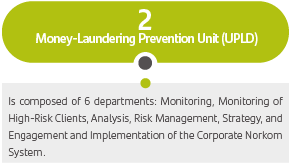

To achieve our mission, we designed a system for the Prevention of Money Laundering and Terrorist Financing (PMLTF), which stipulates the policies, guidelines, regulations, flows and controls necessary to avoid handling funds from dubious sources.

This system is governed by the General Policy and Procedures Manual, which is reviewed on an on-going basis to ensure compliance with domestic regulations. Furthermore, there is a risk and control certification program, which is implemented twice a year.

Conflicts of Interest

To prevent any act that could be motivated by secondary economic or personal motives, at Santander we have implemented measures that restrict the acquisition or leasing of goods and assets, as well as in transactions and product and service contracts, with companies or people with which there is a vested interest or a family connection.

The Compliance area is responsible for receiving, identifying, analyzing and registering any acts that infringe the General Code of Conduct (CGC). Once the Compliance area has registered the reports, these are then sent to the Compliance Committee.