Environmental Impacts

13. Take urgent action to combat climate change and its impacts.

11. Make cities inclusive, safe, resilient and sustainable.

Environmental Management System

We currently operate under a robust Environmental Management System (SGA for its Spanish acronym) that reaffirms our commitment to the environment. It focuses on guaranteeing the efficient use of natural resources in all our operations, and monitors and controls both the treatment and disposal of the waste and emissions we generate as well as our energy, water and paper use and savings.

Our Environmental Management System SGA is validated by numerous certifications and audits. Since 2003, we have been ISO 14001: 2015 certified by the Spanish Association for Standardization and Certification (AENOR), guaranteeing strict compliance with this standard. In 2019, Santander Mexico’s corporate building in Santa Fe and its buildings in Querétaro - CTOS, Data Center II and Contact Center – completed the External Monitoring Audit by AENOR. Given that there were no non-conformities, we remain ISO 14001 certified.

Internal Environmental Awareness Measures

In 2019, we implemented the following environmental training sessions:

- • Corrective Measures Workshop.

- • Course on Environmental Law in Mexico.

- • Environmental awareness for contractors, focusing on sustainability, lifecycle, environmental risk and the principles of ISO 14001:2015.

Another program that involved the participation of our employees was our What’s Your Footprint (¿Qué huella dejas?) workshop, held on World Environment Day. This workshop focuses on explaining to employees what a personal carbon footprint is, the impact that this has on the environment, the most common habits that boost it, simple steps to reduce it at home and at the office, and the benefits of reducing our personal carbon footprints.

Furthermore, during the year, we held an internal Environmental Awareness campaign entitled Let’s Create a Good Environment (Hacemos un buen ambiente), in which we communicated a range of messages via e-mail and other platforms regarding proper waste disposal, efficient water and paper use, and the elimination of single-use plastics.

Emissions

We understand that one of the major contributing factors to climate change is global warming. That is why, as a Responsible Bank, we strive to optimize our processes to help decrease the GHG emissions we produce as a result of our day-to-day activities.

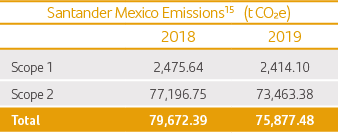

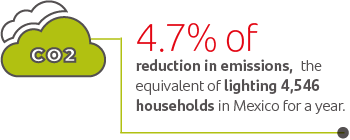

In 2019, total Scope 1 and 2 emissions reached 75,877.48 tCO2e.

15 15The calculation of Santander Mexico’s Carbon Footprint for 2019 was undertaken using the methodology proposed by the GHG Protocol Corporate Accounting and Reporting Standard, the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD), satisfying the requirements of ISO 14064-1, NMX-SAA-14064 and that stipulated in the Climate Change Law in the area of the National Emissions Registry and considering the Calorific Powers published by CONUEE (2020), the Global Warming Potentials defined by the GHG Protocol and the National Electric System’s Emission Factor for the period 2019 (CRE). The calculation considers an operational approach. The GHGs considered in this calculation are: carbon dioxide (CO2), nitrous oxide (N2O) and methane (CH4).Consumption

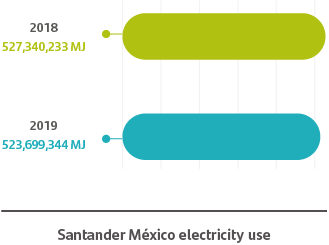

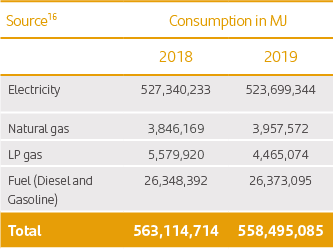

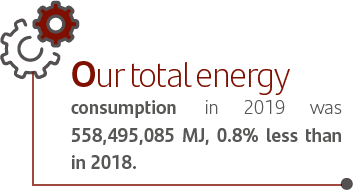

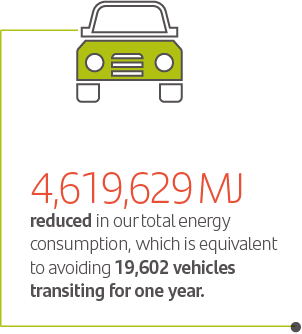

Energy Consumption

To be more energy efficient, we have implemented a range of tools to measure and identify areas in which our energy consumption is highest and take the steps necessary to rectify this situation.

7. Ensure access to affordable, reliable, sustainable and modern energy for all.

Energy Index Design

We created an index based on the parametrization and regionalization of electricity consumption at our branches to determine which of them are major energy consumers in order to implement specific measures to rectify the situation.

This index measures annual energy consumption per unit of usable area (kWh per year / useable mm2) of each branch, generating energy performance curves and consumption trends and opportunely identifying any deviations.

Use of Clean Energies

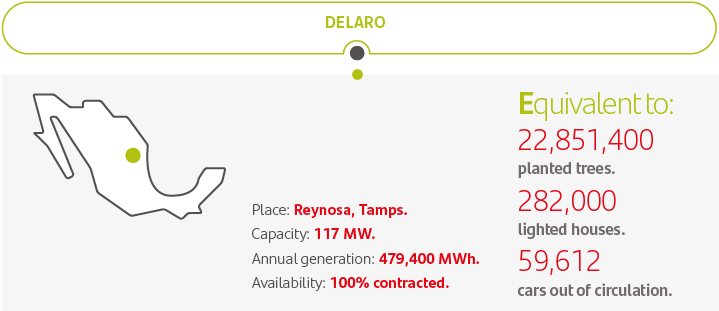

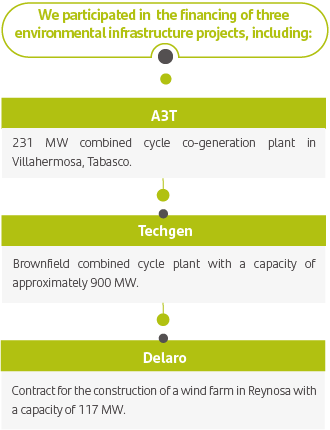

A clear example of our internal operations was the signing of a PPA (Power Purchase Agreement) to cover 30% of Santander Mexico’s total consumption. We signed this agreement with Ammper, a renewable energy company in Mexico.

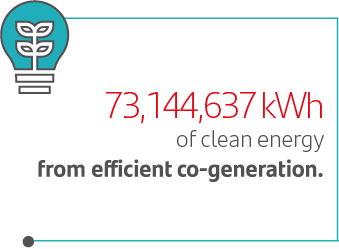

The origin of this renewable energy will be the Delaro wind farm, which is being built by Thermion and should be completed by 2020. Once up and running, the farm will provide 45 GWh per year, which represents a little over 30% of our consumption from the national grid. It is important to mention that of our total current consumption, 50% comes from efficient natural gas co-generation, while 30% will come from a renewable wind source. This is the first step in achieving our local goal, which is aligned with our global goal of using 100% renewable energy by 2025.

16 The consumption of natural gas, LP gas and diesel was calculated based on utility bills, which were converted into MJ using the calorific values published by CONUEE https://www.gob.mx/cms/uploads/attachment/

file/538168/LISTA_DE_COMBUSTIBLES_2020.pdf

Energy Efficiency

To reduce our energy use, we implemented the following measures:

- • Substitution of Chilled Water Pumps at our Corporate Offices in Santa Fe.

- • Changes to Lighting at Modules in our Corporate Offices in Santa Fe.

- • Alternative Energy Supply at our Buildings:.

- • Branches and Offices.

- • CTOS Operations and Technology Center.

- • CTOS II Data Processing Center.

- • CCS Santander Contact Center.

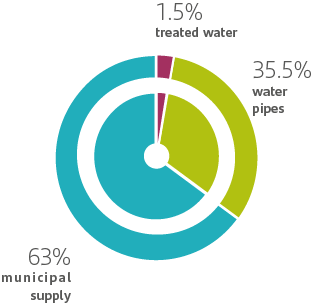

Water Use

In 2019, we implemented a number of internal communication campaigns to raise awareness of water use.

During the year, the total amount of water we used17 reached 461,258.75 m3 of which 6,799m3 was treated water, 154,571m3 comes from pipes and the rest was from the local water supply.

17 Water use was calculated using utility bills issued by several local, state and/ or federal water authorities.

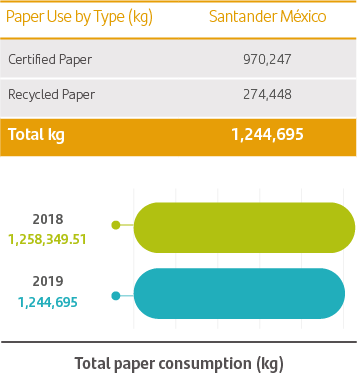

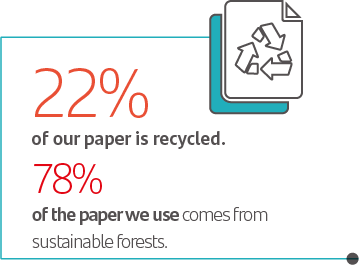

Paper Use

15.2 By 2020, promote the implementation of sustainable management of all types of forests, halt deforestation, restore degraded forests and substantially increase afforestation and reforestation globally.

We are serious about our goal of acting sustainably: we have been working on responsible paper use, ranging from the way in which we procure it to the promotion of internal paperless campaigns that aim to reduce our daily use of this resource.

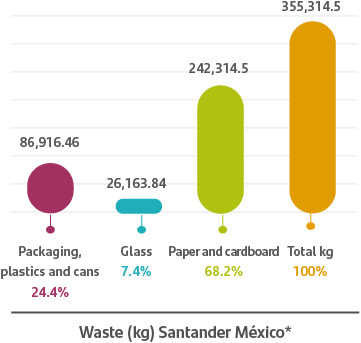

Waste Management

At Santander Mexico, we separate waste from the source to help decrease disposal in landfills. We have achieved this by implementing waste separation campaigns within the institution to help raise awareness among our employees.

Reduction of Single-Use Plastics

During 2019, in accordance with the global goal to eliminate single-use plastics, in Mexico, we implemented a number of measures, including:

Canteens:

- • Elimination of plastic bags for cutlery.

- • Compostable and biodegradable take-away food containers.

Coffee Machines:

- • Use of biodegradable cups.

Vending Machines:

- • Withdrawal of drinks in plastic containers, replacing them with aluminum cans.

Elimination of Bottled Water:

- • Reduction in the use of PET bottles within our buildings.

- • Water fountains to fill up water bottles.

- • Installation of filters and water fountains.

*All waste generated at Santander Mexico is classified as non-hazardous

Suppliers

At Santander, we are committed to ensuring that our suppliers share our ethical, legal, social, environmental and economic criteria and values. All suppliers who sign a contract with one of the Group’s entities are responsible for ensuring their organizations have specific processes in place to protect the environment, including:

Benchmarks for the use of potable water, detergents, cleaning supplies, hazardous materials, among others.

Employee training covering their respective internal procedures, in addition to those of the Environmental Management System, and materials provided by Grupo Santander.

Order and cleanliness: implementation, execution and maintenance of the 5S quality program.

The contracts entered into by Santander México and our suppliers, except for the excepted ones, include a Corporate Social Responsibility clause in which the supplier reaffirms their commitment to aligning their processes with the United Nations Global Compact:

- • Human Rights

- • Workplace Standards:

- • Respect for the freedom of association, the elimination of forced or compulsory labor, the abolition of child labor, and the elimination of discrimination in respect of employment and occupation.

- • Environment:

- • Promotion of employer responsibility.

- • Implementation of environmentally-friendly technologies.

- • Fight against Corruption:

- •Prevention of extorsion and bribery.

By including environmental and social requirements in the contracts and agreements we enter into with our suppliers, we have decreased the impact on the environment, improving processes that enable us to reduce risks.

During the supplier approval process in company dimension, we include indicators regarding quality, environmental management, labor relations, prevention risk and corporate social responsibility.

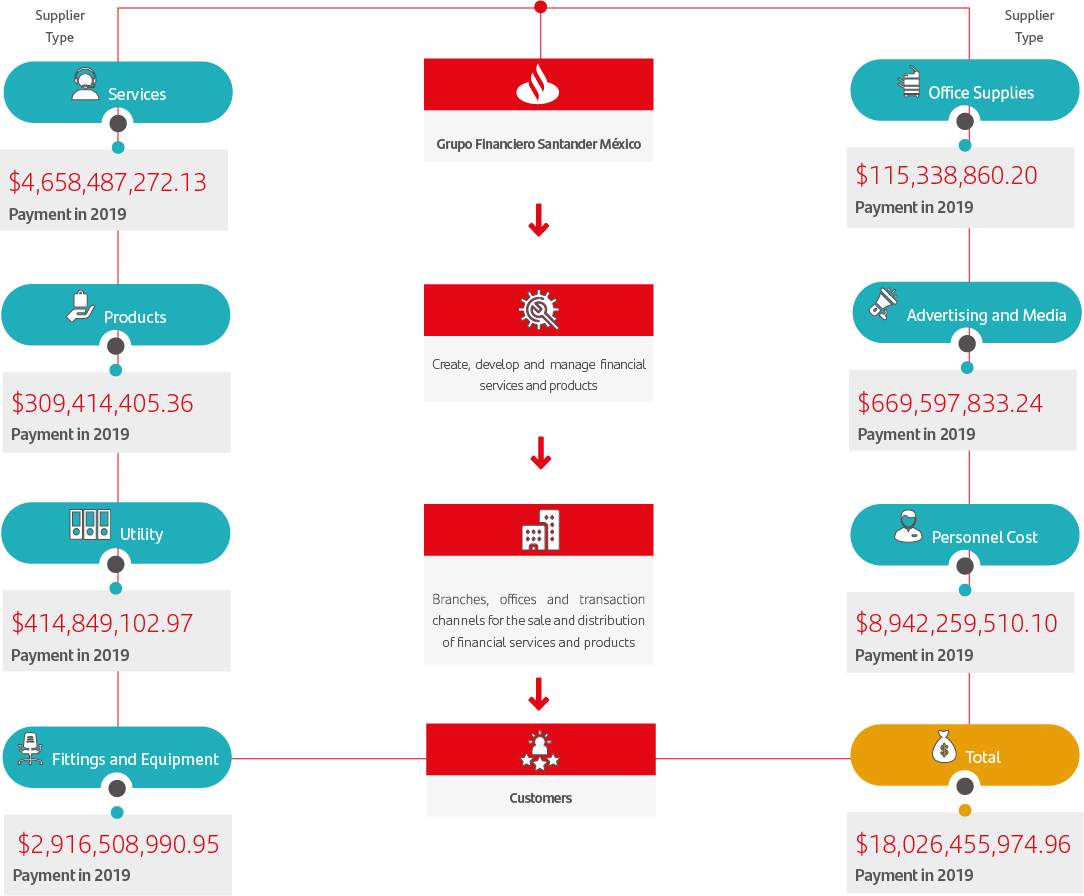

In 2019, we had 4,093 suppliers who offered services valued at MXN $18,026,455,974.96 These include employee benefits and taxes, among other payments made to third parties, which are not included in the supply chain.

The Integrated Expense Management department is tasked with defining, monitoring and evaluating all third-party payment and procurement processes with the support of Aquanima, the Group’s procurement hub.

The local Supplier Committee identifies the risks associated with the outsourcing or provision of services during the contractual period with suppliers.

Sustainable Financing and ESG Risk Assessment 19

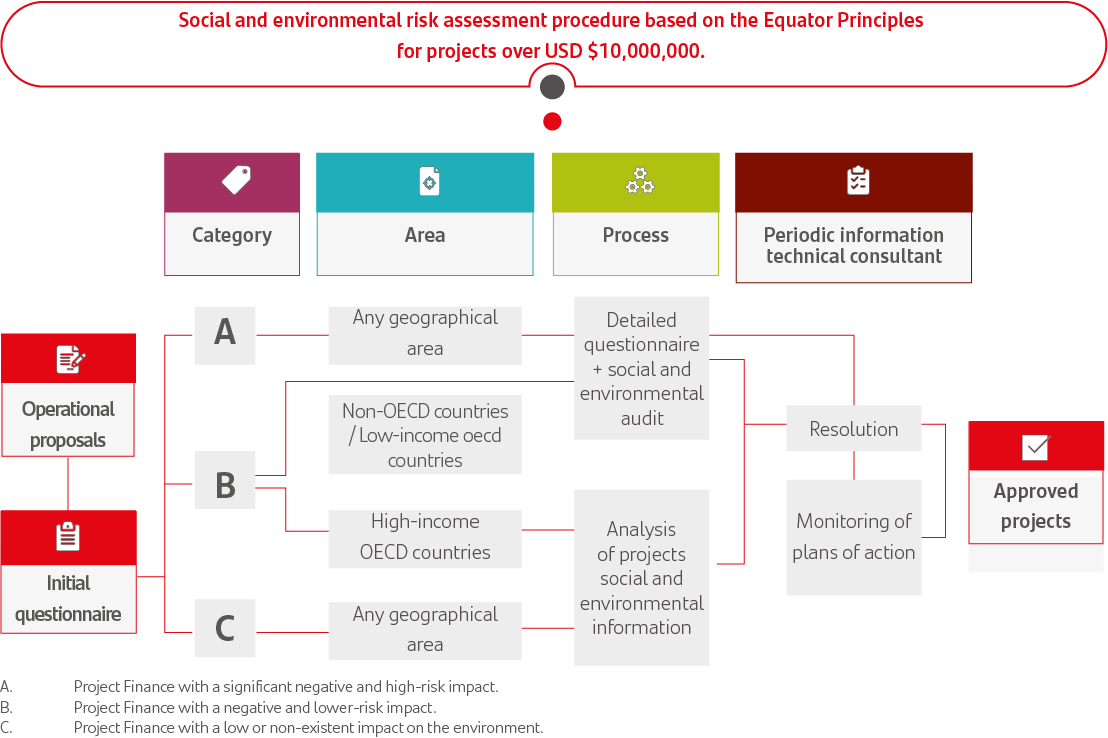

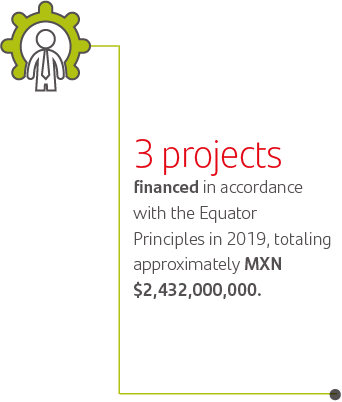

In strict compliance with the Equator Principles, at Santander we have measures in place to analyze the social and environmental risks inherent in financial projects.

19 Environmental, Social and Governance.Assessment of Social and Environmental Risks

Target 9.4. By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes, with all countries taking action in accordance with their respective capabilities.

The Group’s Social and Environmental Policy specifies that any project over USD $10 million must comply with the Equator Principles, the agreement among global financial institutions that governs the financing of projects through a responsible, ethical and transparent approach that also encompasses social and environmental awareness.

To approve any project finance, it must follow the steps described below:

1

The project must have a “B” or “C” rating in the questionnaire. Both the suggestions from the Environmental consultant and the plans of action must be outlined.

2

The process is formalized through a credit agreement. The obligations clause contained in the contract entered into with the recipient of the loan include obligatory environmental deliverables.

3

The customer has a period of 60 to 90 days after the year the contract is signed to present their environmental compliance report. In most cases, this report is drafted by an independent specialist.

4

If full compliance is not achieved, the specialist must include the improvements that need to be made to the project. The environmental scope of each contract depends on the characteristics of the project itself.

5

If the improvements are not implemented on-time and in an appropriate manner, the customer must request the obligations clause in the contract be modified.

6

If no report is received in the timeframe agreed upon, then the customer is deemed to be in breach of contract. In this is the case, the bank notifies the customer and the grace period begins, which is generally a 30-day period.

Project Finance Consultancy Services, when the total capital costs of the project exceed USD $10 million.

Project Finance, when the total capital costs of the project exceed USD $10 million.

Corporate Loans linked to Projects(including Export Financing in the form of Buyer Credits), when the following four criteria are met:

- • The majority of the loan is linked to a project over which the customer has effective operational control (directly or indirectly).

- • The total loan amount is at least USD $10 million.

- •The individual commitment with the EPFI (Equator Principles Financial Institution), prior to syndication or resale, is at least USD $50 million.

- • The loan period is at least 2 years.

Bridge Loans with a payment period of less than two years to be refinanced through Project Finance or a Corporate Loan linked to Projects which will, foreseeably, meet the relevant criteria.

Auneti

Construction and operation of 84.7 km of the Nuevo Necaxa -Tihuatlán highway.

Pirámides

Conservation, reconstruction and traffic services for the Pirámides – Tulancingo – Pachuca highway.

AUTASA

Refinancing of 39 km of the Talimán - Tapachula highway, along the Cd. Hidalgo branch.

Miyana

Mixed use development on a plot totaling 43,954 m2 with 504,540 m2 of construction in Miguel Hidalgo, Mexico City.

PTAR Hermosillo

Service Provision Contract granted by Agua de Hermosillo for a Water Treatment Plant with a capacity of 2,500 l/s.

RCO

34.5-year federal concession for the administration of 4 highways in Mexico: Maravatío – Zapotlanejo, Guadalajara – Zapotlanejo, Zapotlanejo – Lagos de Moreno and León – Aguascalientes.

Ramones Norte

Development, construction and operation of a natural gas pipeline that will start in Los Ramones, Nuevo León and reach San Luis Potosí, with an estimated length of 456 km.

COINSAN

Mini-Perm loan for 10 years with an underlying credit for 12 years.

TAJIN

Development, construction and operation of an integrated fuel reception and delivery system from the Port of Tuxpan, Veracruz, to Tula, Hidalgo.