New Product Marketing and Transparency

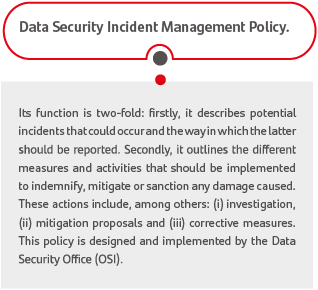

We strive to ensure that our operations are based on transparency, which is why we make sure our customers understand both the benefits and possible difficulties of the new products we market.

As part of our best practices, we have created a regulatory framework to prevent, mitigate and minimize risks posed by the marketing of products during the pre-sale, sale and post-sale processes. The Local Marketing Committee (CLC) coordinates all activities relating to the marketing of our products.