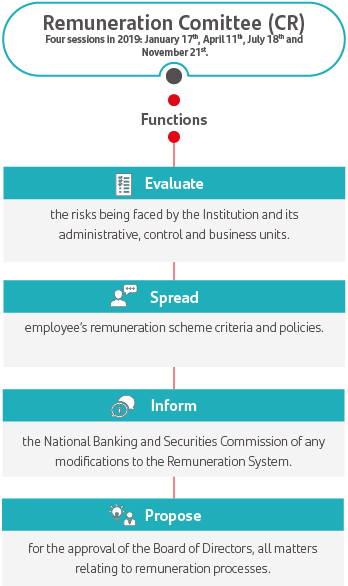

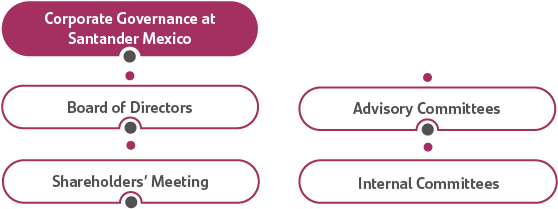

Furthermore, Corporate Governance is responsible for guaranteeing compliance with the highest international sustainability standards and ensuring that all our operations are undertaken in an ethical, institutional and responsible manner.

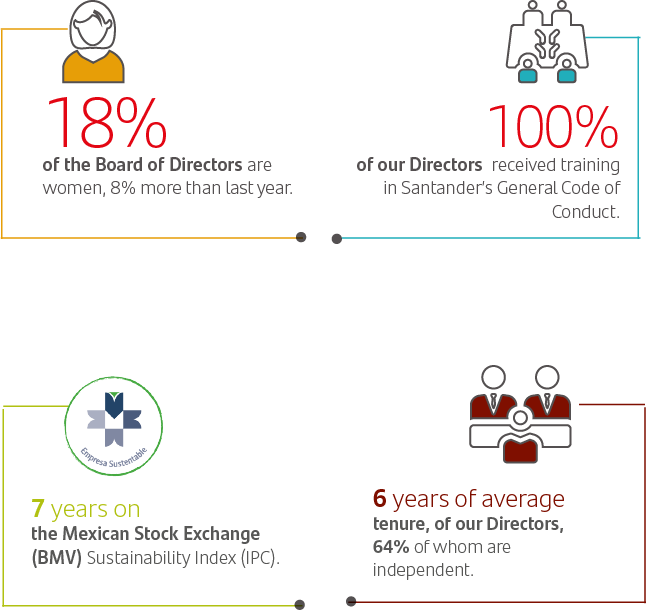

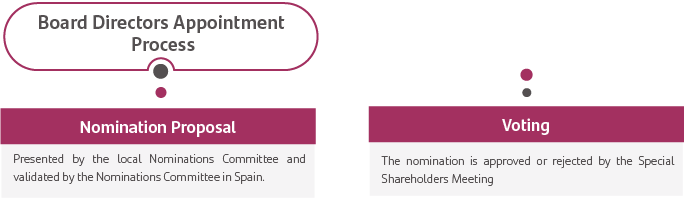

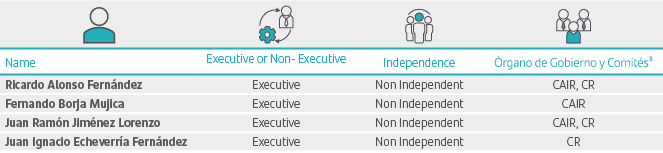

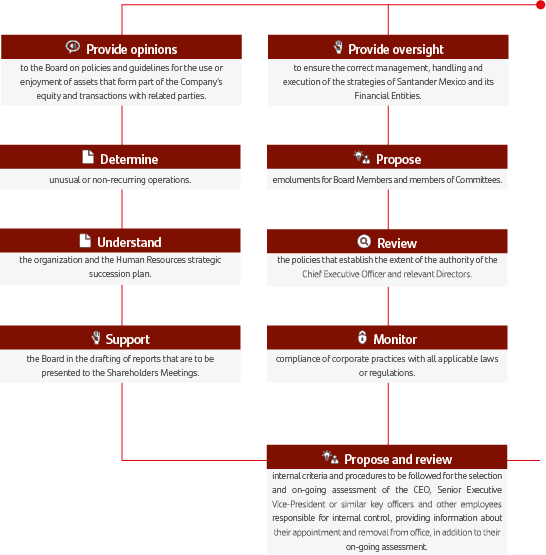

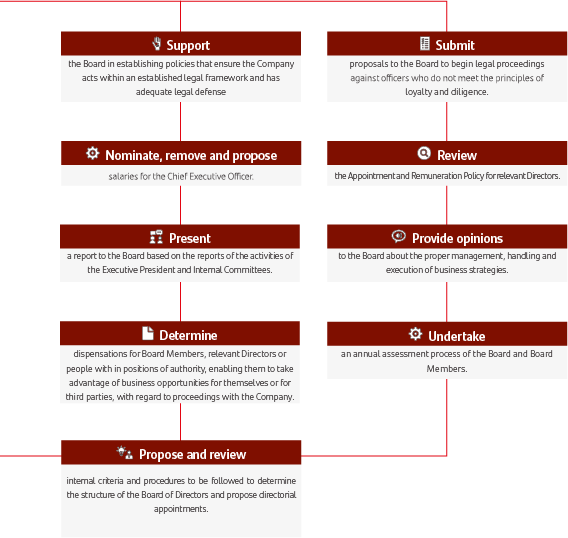

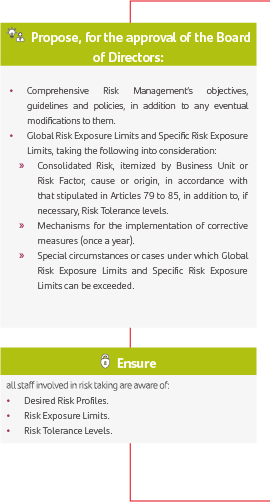

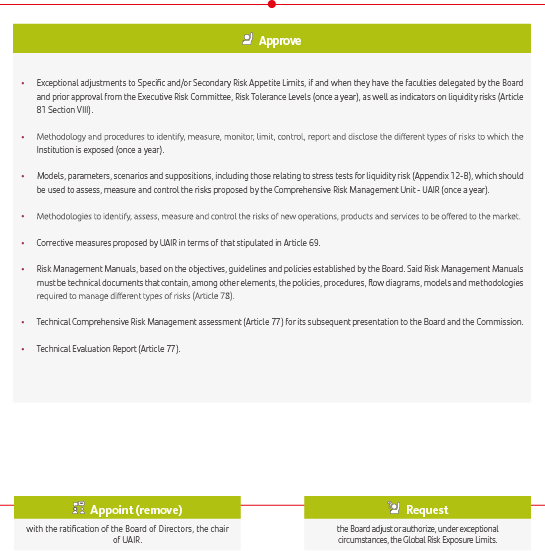

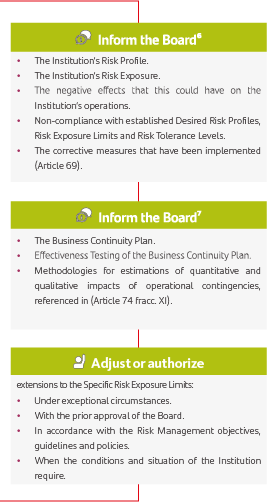

The Board of Directors and its Committees are responsible for reviewing, authorizing and monitoring all activities governed by Santander Mexico’s regulatory framework. They are also responsible for ensuring the company’s resources are used responsibly and optimally.