and Strategy (corporate)

Santander Way

Our strategy is built around a virtuous circle based on loyalty

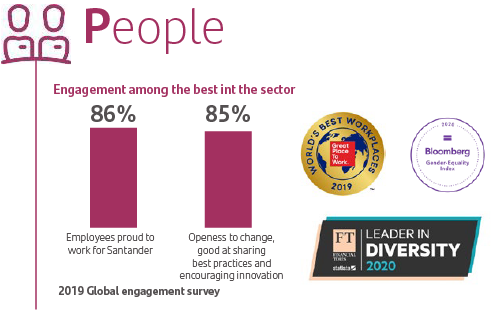

Employees who are engaged ...

- • Our aim is to be an employer of choice. Focus on employee engagement, leveraging our SPF culture to retain and attract the best talent.

- • This year we received important recognitions, of note: one of the 25 best companies to work for at global level (Great Place to Work). Leader in diversity 2020 by the Financial Times, and in addition, for the third consecutive year, we lead the Bloomberg Gender-Equality Index.

... generate more loyal customers ...

- • Increase in loyal customers, both individuals and businesses, has resulted in a significant growth in revenues, loans and customer funds.

- • Loyal customers use our digital channels more as they hold more of our products and services and interact with us more often.

... leading to strong financial results ...

- • Ourfocus on customer loyalty is delivering results: alltime record figure in customer revenueA with 3% growth (+4% in constant euros) and accounting for 95% of total revenue.

- • We continued to strengthen our balance sheet, generating more capital and improving credit quality.

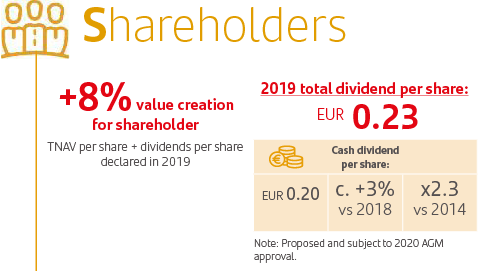

- • We continue growing our cash dividend, as we have been doing for the last five years.

... and more investment in communities, helping to motivate and engage our people...

- • We remain committed to generating profit in a more responsible and sustainable way.

- • Initiatives and actions to support inclusive and sustainable causes, and good causes in the communities in which we operate.

Our business model

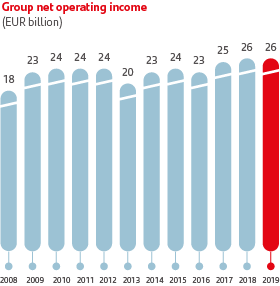

Resilent profit generation throughout the cycle

In 2019, once again, our business model generation demonstrated strength and resilience, supported by a disciplined execution against our strategic priorities.

Net operating income = Total income-operating expenses.

Our business model and our track record executing our strategy support the delivery of our mid-term goals while we are building a Responsible Bank

Execution of our three-pillar plan to drive profitable growth in a responsible way

- 1. Improving operating performance

- 2. Optimising capital allocation

- 3. Accelerating the digital transformation through Santander Global Platform

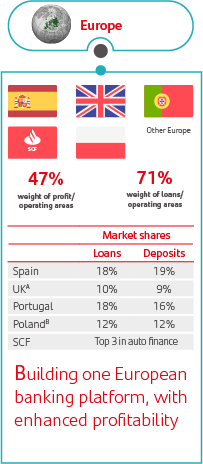

A. Includes London Branch.

B. Includes SCF business in Poland.

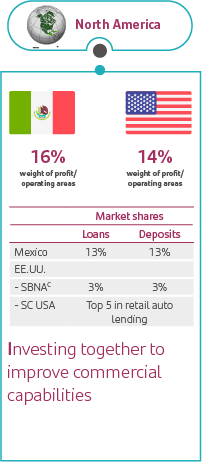

C. In every state where Santander Bank operates.

D. Includes debentures, LCA (agribusiness credit notes), LCI (real estate credit notes), LF (letras financeiras) and COE (structured transactions certificate).

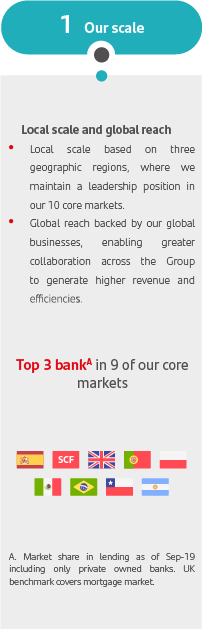

1. Improving operating performance leveraging One Santander:

Three geographic regions (with 10 core markets) to improve productivity and generate new efficiencies:

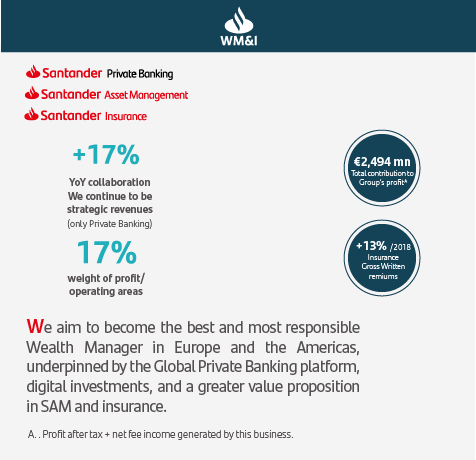

Global businesses to leverage our local scale with global reach and collaboration:

2. Ongoing capital allocation optimisation to improve profitability:

3. Accelerating the digital transformation through SGP:

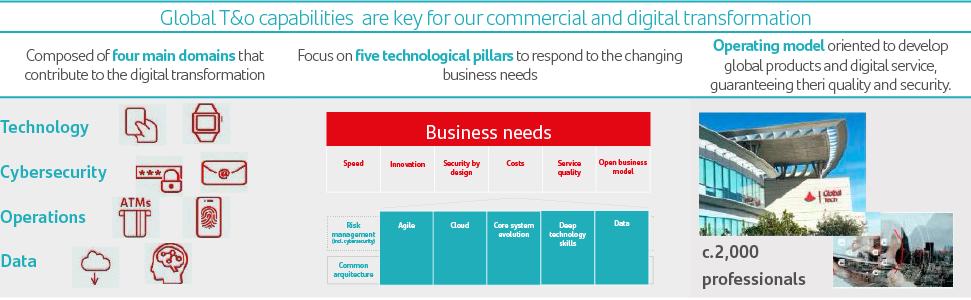

Our technology strategy is aligned with our two-pronged approach of digitalising our core banks and global businesses and building Santander Global Platform, focusing on better serving our customers needs.

Innovation and technological development are strategic pillars of the Group. Our objective is to respond to the new challenges that emanate from digital transformation, focusing on operational excellence and customer experience.

Accelerating digitalisation and building Santander Global Platform. Moving towards One Santander to build simpler, faster and better services.

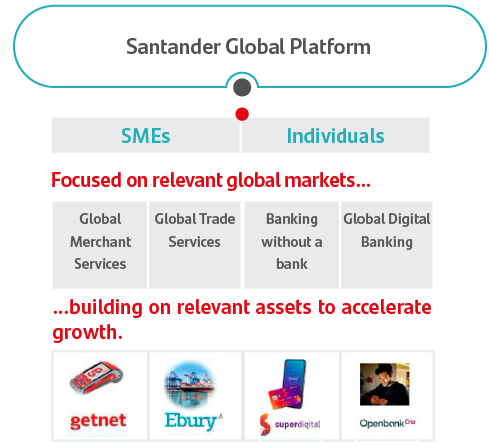

Best-in-class Global payments and digital banking solutions to SMEs and individuals

Digital Payment services as a driver of customer engagement and loyalty.

Built with global plataforms, leveranging our scale for efficiency and customer experience.

Offer to our banks (B2C) and to third parties (B2B2C).

Run autonomously, with a blend of tech and banking talent.