Inclusion

1.4 By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to basic services, ownership and control over land and other forms of property, inheritance, natural resources, appropriate new technology and financial services, including microfinance.

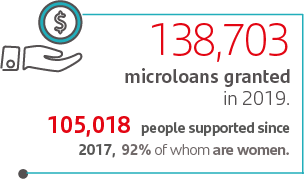

Microloans

At Santander, we have focused our efforts on helping people and businesses prosper. Which is why several years ago we chose microloans as one of the major services required to help drive the inclusive and sustainable growth of our customers.

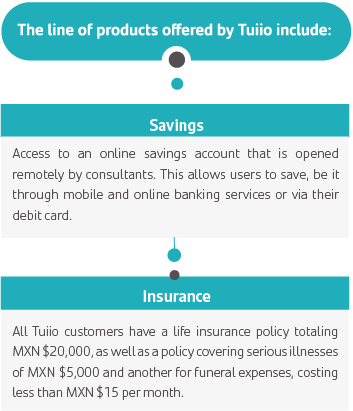

The Tuiio customer support model currently comprises 85 branches, in addition to kiosks and consultants, enabling us to better engage with our customers and support them during the product sign-up process. All Tuiio customers have 100% online and commission-free savings accounts, and they are given a debit card that is linked to the account.

Tuiio offers a comprehensive range of products that not only include a tailor-made loan, but also savings and insurance products that help people to cover their needs within financial cycle. The products on offer have a major online component that favors operational efficiency and a better user experience.

Download Tuiio Annual Report.

only available in spanish

This program is based on the key principles of financial inclusion: inclusive growth, the digital revolution, accessibility and customer protection. We want to have a sustainable and profitable social impact on our customers through our financial and non-financial services.

We have developed indicators to measure the short-, mid- and long-term social impacts of Tuiio based on the generation of responsible and shared value, as well as longterm sustainable and comprehensive social development and economic well-being.

At Tuiio, our employees are always ready to offer best-in-class service. We achieve this by offering them training in areas that range from customer service to ensuring they have the skills necessary for both their professional and personal lives.

In 2019, we offered our employees the following courses:

What’s up with my finances?

A Financial Literacy program that certifies 100% of all new employees in personal finance issues and the proper use of financial services.

Finance Tips

An on-going communication campaign every Friday via WhatsApp groups that provides tips on financial services and personal finances.

Customer Service

During the induction process, all our new employees take part in a customer service workshop.

Products

Recognition of “Excellence” by the “Leading Women Awards” for the Executive Director of Financial Inclusion Santander México.

Norma Castro was presented with a Leading Women Award by the World Business Council for Sustainable Development (WBCSD) for her work spearheading the Tuiio financial inclusion program. The Leading Women Awards recognize the efforts being made by women leaders around the world who are contributing to achieving the United Nation’ goal of achieving gender equality and empowering all women and girls by 2030.

Norma was the first Mexican woman to win this award in 2019 given “her efforts to reinvent the traditional microfinance models in Mexico” and “the success of Tuiio in empowering those who are underserved by banks by offering financial services”.

"I am very proud to lead Tuiio and be part of Santander, because I am convinced that companies, especially the largest in the world, have a unique opportunity to promote this type of initiatives that contribute to sustainability and give back to society ”.

Norma Castro

Executive Director of Financial Inclusion.

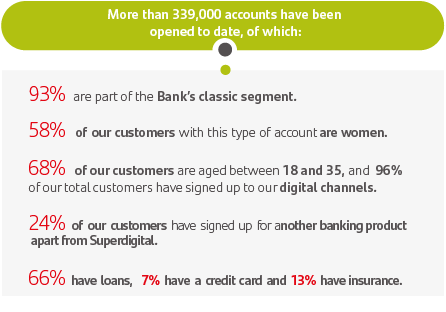

Superdigital

Committed to promoting the financial inclusion of people in Mexico, we developed Superdigital: a level-two account with a simple online application process for people over the age of 18 who have an active e-mail account and cellphone number. There are no commissions for opening or using the account, and it takes around 8 minutes to activate and be ready to be used online. Some of the benefits of Superdigital include the linked Mastercard debit card that is accepted worldwide and the fact that customers can use all of Santander’s channels, including branches and ATM’s.

Financial Education

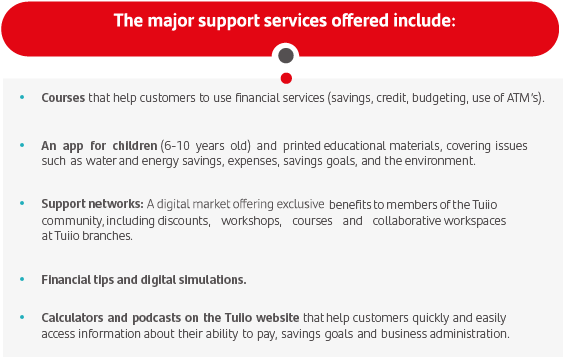

Our Financial Education model is aligned with our goal of driving awareness among our customers about understanding the state of their finances, offering them tools to help them make the right decisions and optimize their financial health.

We are a member of the Financial Education Committee of the Mexican Association of Banks (ABM), where we are also members of the Steering Committee and a specialized committee comprising the five largest banking institutions in Mexico.

- • As part of the ABM, we work alongside other banks from the sector on the “Young People Building the Future” program. In conjunction with the Interactive Museum of Economics (MIDE), from Banco de México, we have designed financial education materials for those beneficiaries chosen by the banking sector to take part in this federal government training program.

Through a range of innovative and interactive measures, we offer financial education programs to our customers and the general public to help them achieve their goals. These programs include: Financial Health with Tuiio, our website, our Mobile Movie Theater, our Guardians of Savings program, and National Financial Education Week.

Financial Health with Tuiio

Through our application, we promote healthy personal finances among our customers. We offer online information about the benefits of formal savings, proper debt management and the use of ATM’s and multi-function ATM’s. After finishing these modules, the participant is awarded a diploma. This application is available on Android smartphones. In 2019 we provided financial education to 19,286 clients.

Financial Education Website

In 2019, we redesigned our website to provide more comprehensive and consolidated content for different segments of the population. The site now offers:

- • A course covering the basic concepts of personal finances, as part of the institutional ABC of Your Finances program.

- • Tuiio content that focuses on the unbanked.

- • Information to help university students embark on their financial lives.

- • Interactive materials, such as calculators, simulators, videos and infographics.

- • Courses to help SME’s overcome their major challenges, helping drive their development and increase their solvency.

In 2019 we beneffited 10,925 people with our content.

Tuiio – Mobile Cinema

In this entertainment space, we promote family time and financial education, as well as the proper use of debit cards. The program is based around a mobile cinema that travels to areas neighboring Tuiio offices. In 2019, it visited 34 areas (events). In 2019 it was carried out in 34 locations (events) beneffiting 17,785 people.

National Financial Education Week

Every year, the federal government, through the National Commission for the Protection and Defense of Users of Financial Services (CONDUSEF), organizes National Financial Education Week (SNEF), during which the public and private sectors join forces to provide information to the general public about how to better manage their personal finances, including how to responsibly use financial products and services. In 2019, our stand benefitted 10,950 people through the three interactive programs: Tuiio – Building Your Finances, Tu Yo Financiero and the institutional ABC of Your Finances program.

Guardians of Savings

All Tuiio offices have tablets with preinstalled applications that promote playing as a learning tool for children between 4 and 12 years of age. These games focus on financial and non-financial savings and raising awareness about incidental expenses. In 2019, 1,389 children beneffited.

also considered.