and strategy

The Santander Way remains unchanged...

To help people and businesses prosper

To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities

Everything we do should be Simple, Personal and Fair

... continuing to deliver for all our stakeholders

Our Business model

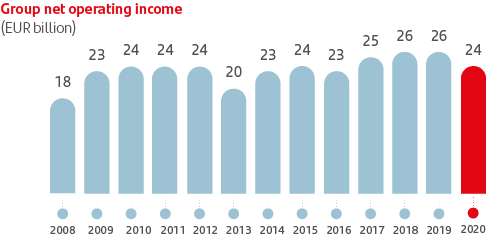

Resilient profit generation throughout the cycle

In 2020, Grupo Santander delivered a resilient operating income within the environment arising from the covid-19 crisis, supported by a disciplined capital allocation in accordance with our strategic priorities

Net operating income = Total income - Operating expenses.

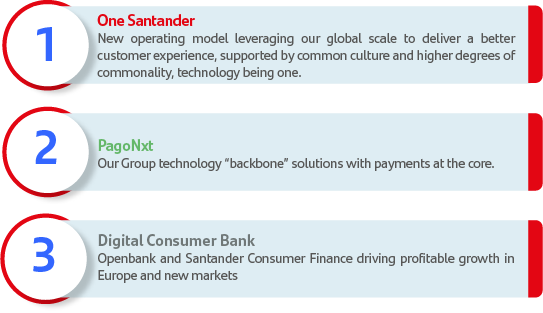

The Santander of Tomorrow – 3 priorities for profitable growth

1. One Santander:

Creating a better bank for our customers with a new operating model...

A. Medium term goals for the efficiency ratio do not represent guidance. The actual efficiency ratio may vary materially in the medium term.

B. Excluding SCF+Openbank, which would have an efficiency ratio of c.39% and a RoTE of 13%-15%. Europe, including SCF+Openbank, would have an efficiency ratio of c.43% and a RoTE of 12%-13%.

C. Medium term goals for underlying RoTE do not represent guidance. The actual underlying RoTE may vary materially in the medium term.

D. Adjusted RoTE for excess capital in the US.

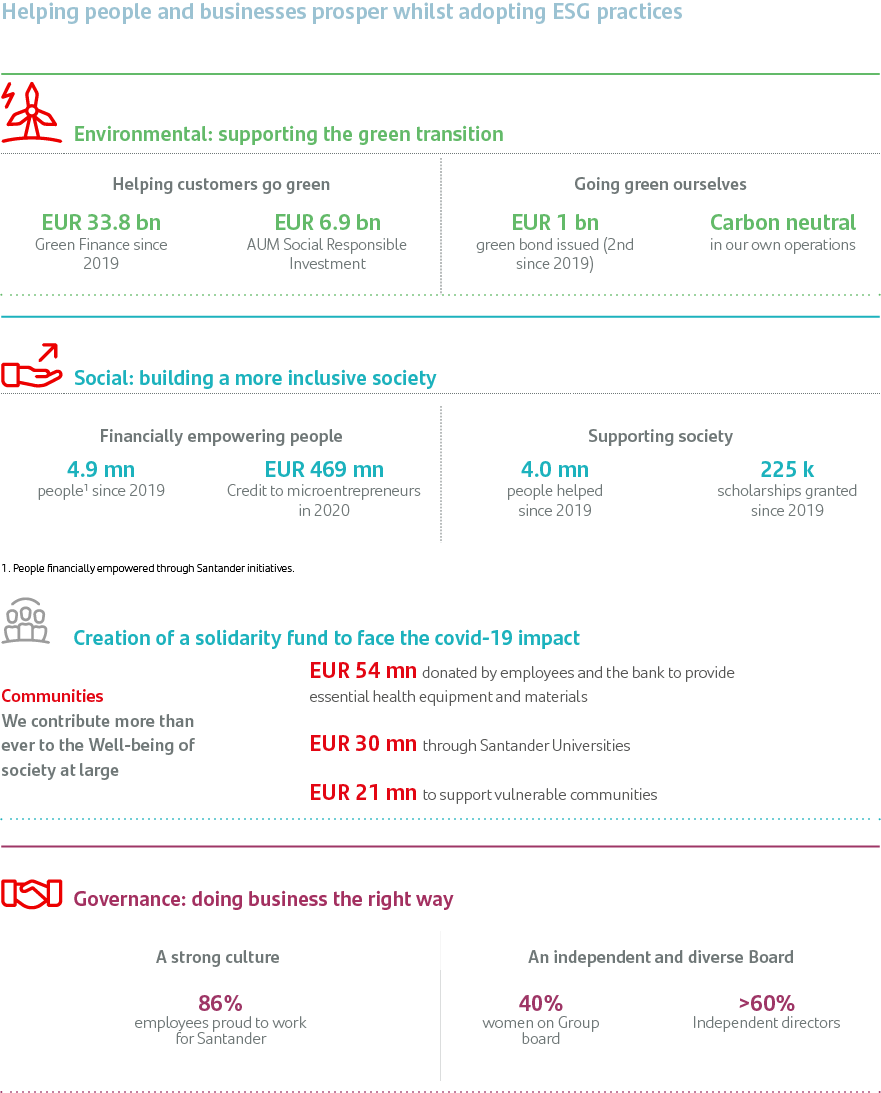

We have integrated ESG criteria into our new strategic priorities: One Santander Europe has focused on 2020 on rebuilding after covid-19, supporting people (especially more vulnerable communities, in financial distress) and helping customers transition to the green economy.

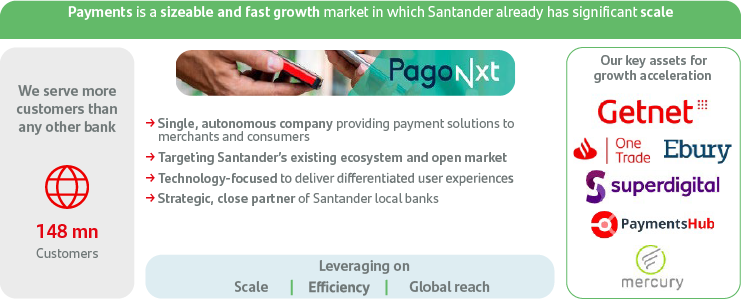

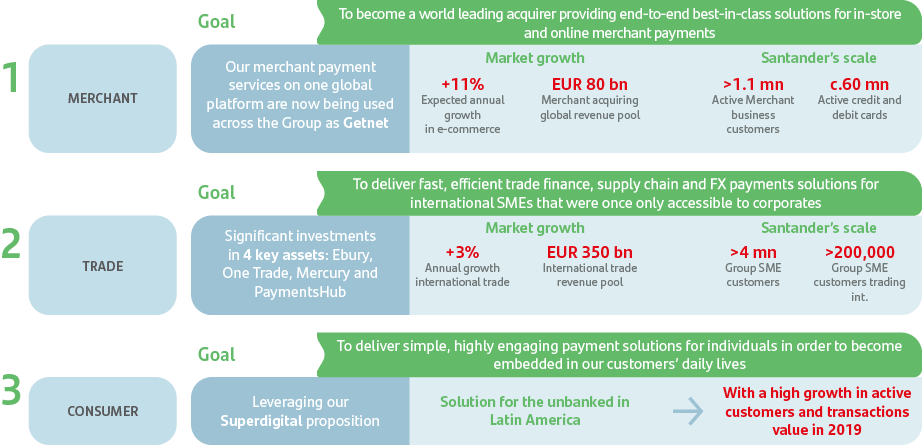

2. PagoNxt:

PagoNxt will help Santander banks deliver payment solutions seamlessly, faster and with better value

Focused in 3 business verticals to accelerate growth, leveraging on scale, ‘being global’ and efficiency

We have integrated ESG criteria into our new strategic priorities: Developed consumer solutions (such as Superdigital) within PagoNxt scope will benefit individual lives through financial inclusion and domestic and international payments for all.

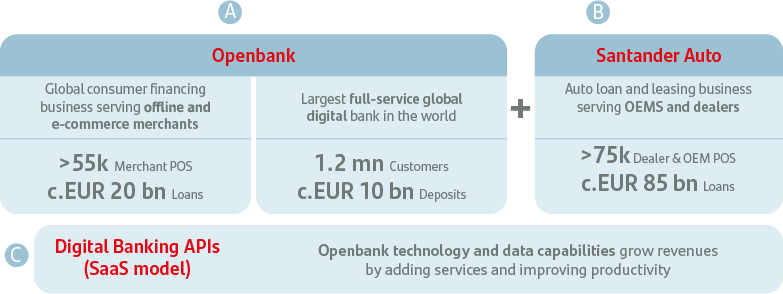

3. Digital Consumer Bank:

Combining the scale and leadership of SCF in Europe with the platform of Openbank. Our vision is to become the largest digital consumer bank in the world

Our ambition: to grow revenues and x2 PATA in the medium term and build the most innovative consumer lending business in Europe

A. Underlying

B. Medium term goals for underlying RoTE do not represent guidance. The actual underlying RoTE may vary materially in the medium term.

C. Medium term goals for the efficiency ratio do not represent guidance. The actual efficiency ratio may vary materially in the medium term.

We have integrated ESG criteria into our new strategic priorities: Digital Consumer Bank is developing business solutions with a positive environmental impact. We have developed green finance solutions for consumers, such as clean vehicles, solar panels or heating systems amongst others.

ESP

ESP