Standards

As a member of ABM, we signed the Association of Mexican Banks’ Sustainability Protocol, which promotes sustainable development within the banking sector through five main areas:

Institutionalization of internal sustainability policies.

Management of environmental and social risks associated with investment or credit processes.

Sustainable investment.

Efficient use of resources in internal processes.

Monitoring and publication of the industry’s sustainability policies and practices.

Sustainable Livestock Working Group

It drives the development of sustainable livestock. It debates and formulates common practices, patterns and principles to be adopted by the sector.

BID Y ACLIMATISSE

A pilot program that aims to consolidate the institutional and operational capacity of Mexican banks to identify and manage environmental, climate and social risks and opportunities, helping financial institutions incorporate the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Committee of Mexican Stock Exchange Issuers

We are an active member of the Committee of Mexican Stock Exchange Issuers. This Committee focuses on relevant issues regarding the opinions, requirements, needs and concerns of the stock exchange, in addition to its regulations, practices and members.

Its goal is to review and discuss issues relating to participation on the stock exchange, in addition to facilitating the participation of issuers in all activities covering regulatory, promotional, development and distribution issues with the goal of consolidating the market.

During 2019, some of the most relevant issues tackled during the Committee’s sessions included:

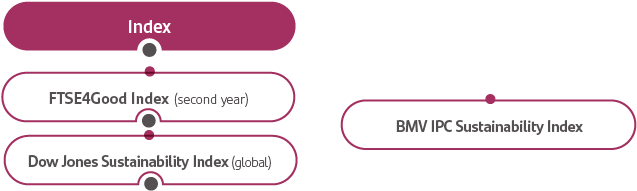

- Changes to the IPC Sustainability Index. It was announced that, as of 2019, RobecoSAM would be tasked with all evaluations regarding BMV indices. An index designed to measure the performance of issuers in terms of Environmental, Social, and Governance (ESG) criteria.

- Analysis of Decree for Fiscal Stimulus for the Stock Exchange. It outlines the fiscal stimulus packages for transactions in the financial sector.

- Bill by the House of Representatives regarding the Participation of Women in Board of Directors. It was stated that this bill aims to reform Articles 19, 24 and 26 of the Stock Market Law.

- Bill by the Senate regarding Class Actions by Companies Listed on the Stock Market. Reform of Article 103 of the Stock Market Law, which considers the possibility that shareholders can seek invalidation and the payment of damages on an individual basis or by means of class actions.

- Methodology for ESG Indices. This index uses the following indices as benchmarks: S&P/BMV IPC, representing the most traded issuers on the market, and S&P Mexico BMI, which includes fibers.